Question: Consider a put option and a call option, which have the same underlying stock, strike price and expiration date (6 months from now). The

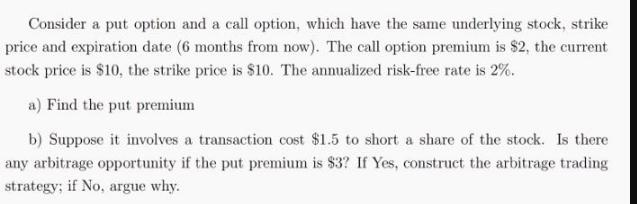

Consider a put option and a call option, which have the same underlying stock, strike price and expiration date (6 months from now). The call option premium is $2, the current stock price is $10, the strike price is $10. The annualized risk-free rate is 2%. a) Find the put premium b) Suppose it involves a transaction cost $1.5 to short a share of the stock. Is there any arbitrage opportunity if the put premium is $3? If Yes, construct the arbitrage trading strategy; if No, argue why.

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

a The putcall parity formula relates the price of a European call option C European put option P the ... View full answer

Get step-by-step solutions from verified subject matter experts