Question: Consider a receive fixed USD to pay fixed CAD Swap. Risk-free rates are taken as OIS (Spot OIS rates are given below with annual compounding).

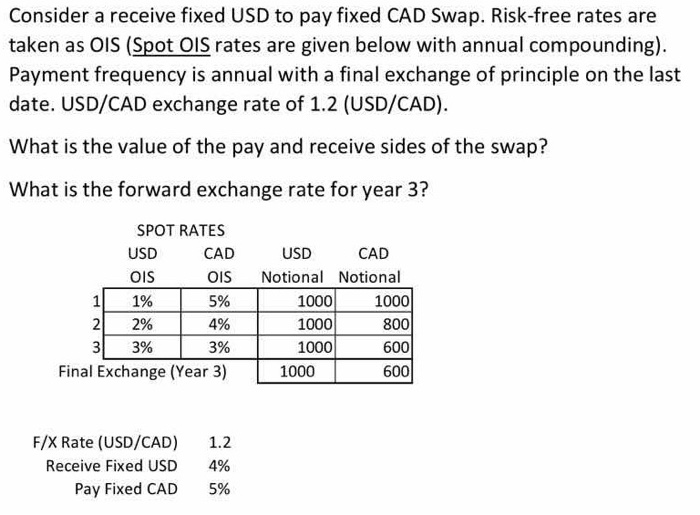

Consider a receive fixed USD to pay fixed CAD Swap. Risk-free rates are taken as OIS (Spot OIS rates are given below with annual compounding). Payment frequency is annual with a final exchange of principle on the last date. USD/CAD exchange rate of 1.2 (USD/CAD). What is the value of the pay and receive sides of the swap? What is the forward exchange rate for year 3? SPOT RATES USD CAD OIS O IS 1 1% 5% 2 2% 4% 3 3% 3% Final Exchange (Year 3) USD CAD Notional Notional 1000 1000 1000 800 1000 600 1000 600 F/X Rate (USD/CAD) Receive Fixed USD Pay Fixed CAD 1.2 4% 5% Consider a receive fixed USD to pay fixed CAD Swap. Risk-free rates are taken as OIS (Spot OIS rates are given below with annual compounding). Payment frequency is annual with a final exchange of principle on the last date. USD/CAD exchange rate of 1.2 (USD/CAD). What is the value of the pay and receive sides of the swap? What is the forward exchange rate for year 3? SPOT RATES USD CAD OIS O IS 1 1% 5% 2 2% 4% 3 3% 3% Final Exchange (Year 3) USD CAD Notional Notional 1000 1000 1000 800 1000 600 1000 600 F/X Rate (USD/CAD) Receive Fixed USD Pay Fixed CAD 1.2 4% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts