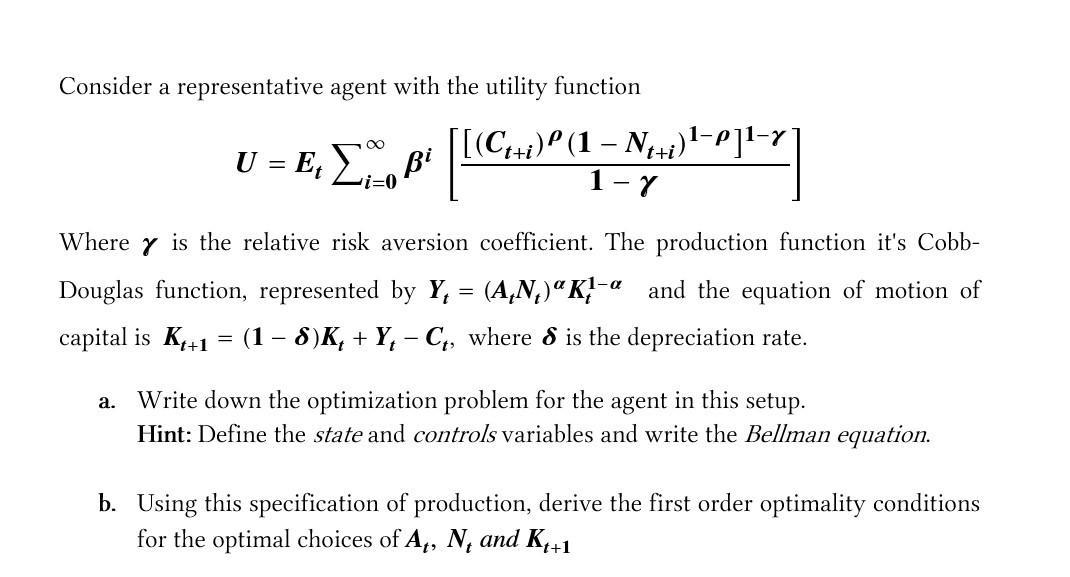

Question: Consider a representative agent with the utility function U = E [0 [[(C+i) (1 Bi +1) (1 = Next) 1-7 Nt+i) -p]- a Where

Consider a representative agent with the utility function U = E [0 [[(C+i) (1 Bi +1) (1 = Next) 1-7 Nt+i) -p]- a Where is the relative risk aversion coefficient. The production function it's Cobb- Douglas function, represented by Y = (AN)"K!-" _and the equation of motion of capital is K+1 = (1 8)K + Y - C, where is the depreciation rate. a. Write down the optimization problem for the agent in this setup. Hint: Define the state and controls variables and write the Bellman equation. b. Using this specification of production, derive the first order optimality conditions for the optimal choices of A,, N, and K+1

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

a Optimization Problem and Bellman Equation The representative agents optimization problem involves ... View full answer

Get step-by-step solutions from verified subject matter experts