Question: Consider a sealed-bid second price auction with three bidders. The seller has a value 0 for the object. Each bidder has a value drawn from

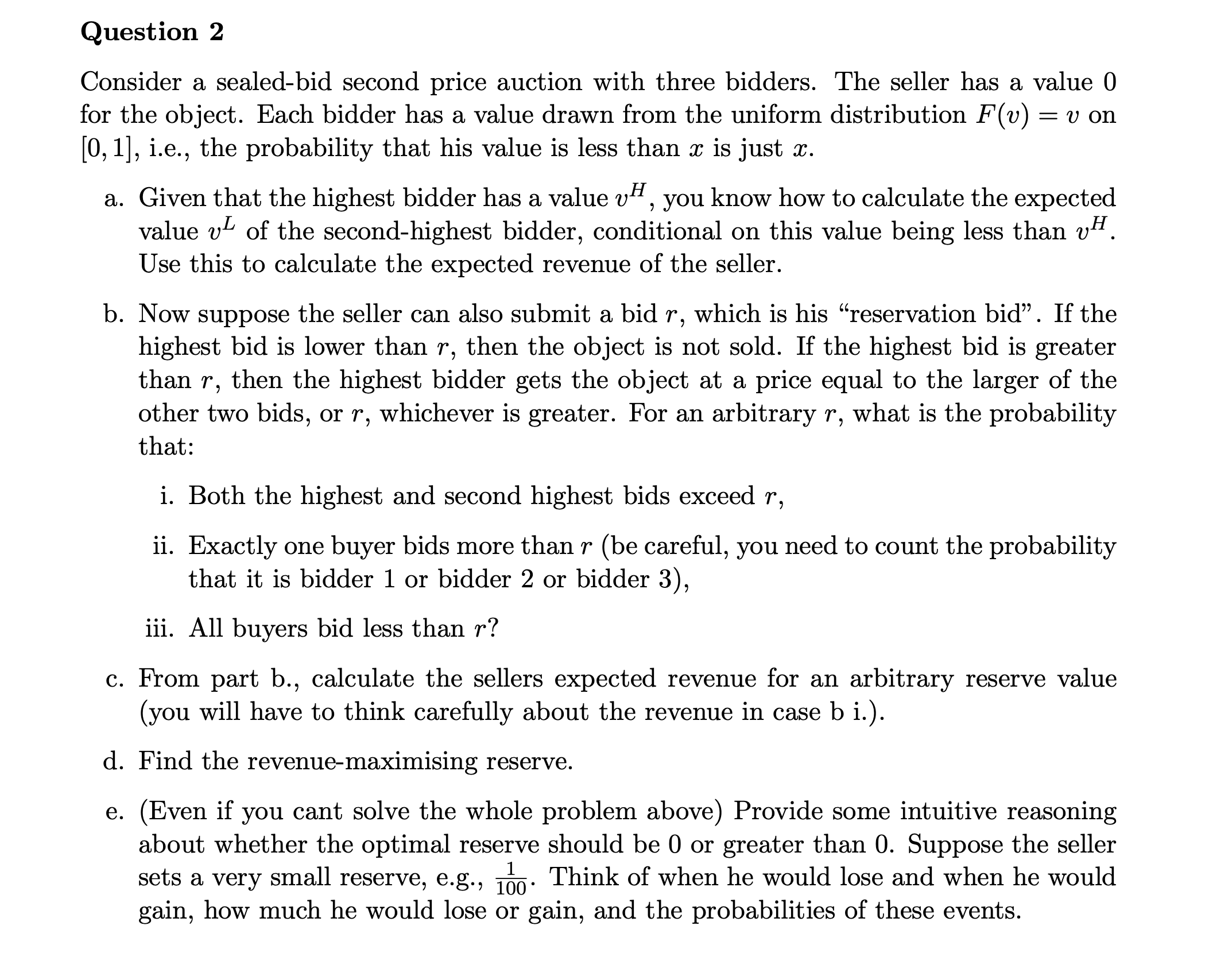

Consider a sealed-bid second price auction with three bidders. The seller has a value 0 for the object. Each bidder has a value drawn from the uniform distributionF(v) =von [0,1], i.e., the probability that his value is less thanxis justx.

a. Given that the highest bidder has a valuevH, you know how to calculate the expectedLH

valuevof the second-highest bidder, conditional on this value being less thanv. Use this to calculate the expected revenue of the seller.

Question 2 Consider a sealedbid second price auction with three bidders. The seller has a value 0 for the object. Each bidder has a value drawn from the uniform distribution F(v) = v on [0,1], i.e., the probability that his value is less than a: is just a). a. Given that the highest bidder has a value 'UH , you know how to calculate the expected value 12L of the secondhighest bidder, conditional on this value being less than UH. Use this to calculate the expected revenue of the seller. b. Now suppose the seller can also submit a bid T, which is his \"reservation bid\". If the highest bid is lower than 7', then the object is not sold. If the highest bid is greater than 7", then the highest bidder gets the object at a price equal to the larger of the other two bids, or 1", whichever is greater. For an arbitrary 7', what is the probability that: i. Both the highest and second highest bids exceed 7", ii. Exactly one buyer bids more than 7" (be careful, you need to count the probability that it is bidder 1 or bidder 2 or bidder 3), iii. All buyers bid less than 1'? c. From part b., calculate the sellers expected revenue for an arbitrary reserve value (you will have to think carefully about the revenue in case b i.). d. Find the revenue-maximising reserve. e. (Even if you cant solve the whole problem above) Provide some intuitive reasoning about whether the optimal reserve should be 0 or greater than 0. Suppose the seller sets a very small reserve, e.g., . Think of when he would lose and when he would gain, how much he would lose or gain, and the probabilities of these events

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts