Question: Consider a single consumer whose utility function is U = I, where I is the yearly income of the consumer. The consumer earns $100,000

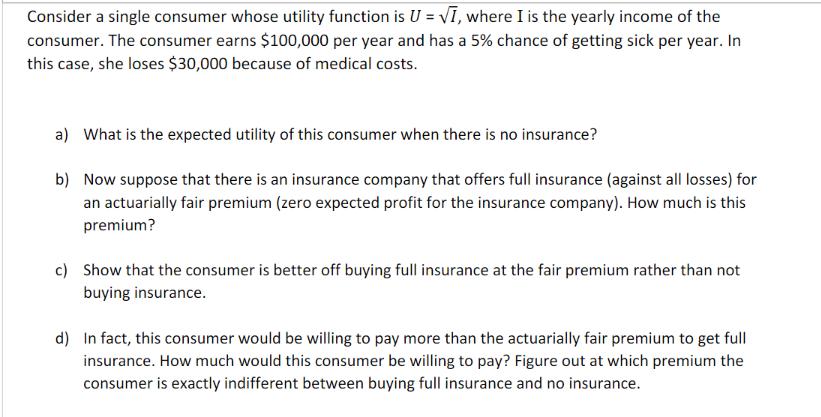

Consider a single consumer whose utility function is U = I, where I is the yearly income of the consumer. The consumer earns $100,000 per year and has a 5% chance of getting sick per year. In this case, she loses $30,000 because of medical costs. a) What is the expected utility of this consumer when there is no insurance? b) Now suppose that there is an insurance company that offers full insurance (against all losses) for an actuarially fair premium (zero expected profit for the insurance company). How much is this premium? c) Show that the consumer is better off buying full insurance at the fair premium rather than not buying insurance. d) In fact, this consumer would be willing to pay more than the actuarially fair premium to get full insurance. How much would this consumer be willing to pay? Figure out at which premium the consumer is exactly indifferent between buying full insurance and no insurance.

Step by Step Solution

There are 3 Steps involved in it

a The expected utility of this consumer when there is no insurance is calculated as follows U VI 100... View full answer

Get step-by-step solutions from verified subject matter experts