Question: Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 16%. Portfolio B has a beta of 0.8

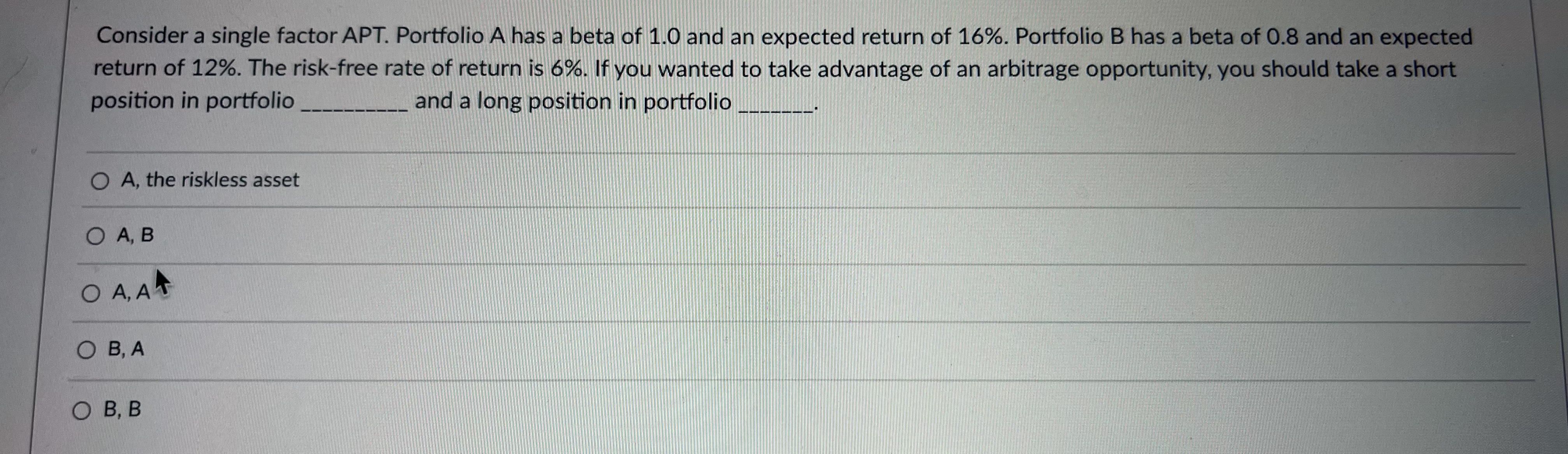

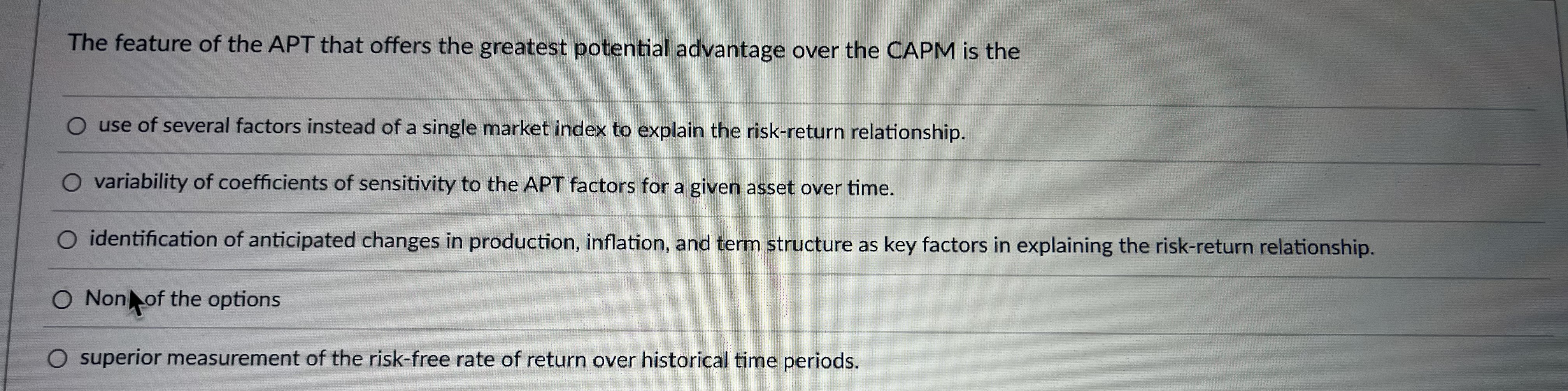

Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 16%. Portfolio B has a beta of 0.8 and an expected return of 12%. The risk-free rate of return is 6%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio and a long position in portfolio A, the riskless asset A, B A, A B, A B, B The feature of the APT that offers the greatest potential advantage over the CAPM is the use of several factors instead of a single market index to explain the risk-return relationship. variability of coefficients of sensitivity to the APT factors for a given asset over time. identification of anticipated changes in production, inflation, and term structure as key factors in explaining the risk-return relationship. Non of the options superior measurement of the risk-free rate of return over historical time periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts