Question: Consider a stock that does not pay dividends. The stock process follows Geometric Brownian Motion dSt = u Stdt + o StdBt, with u 20%

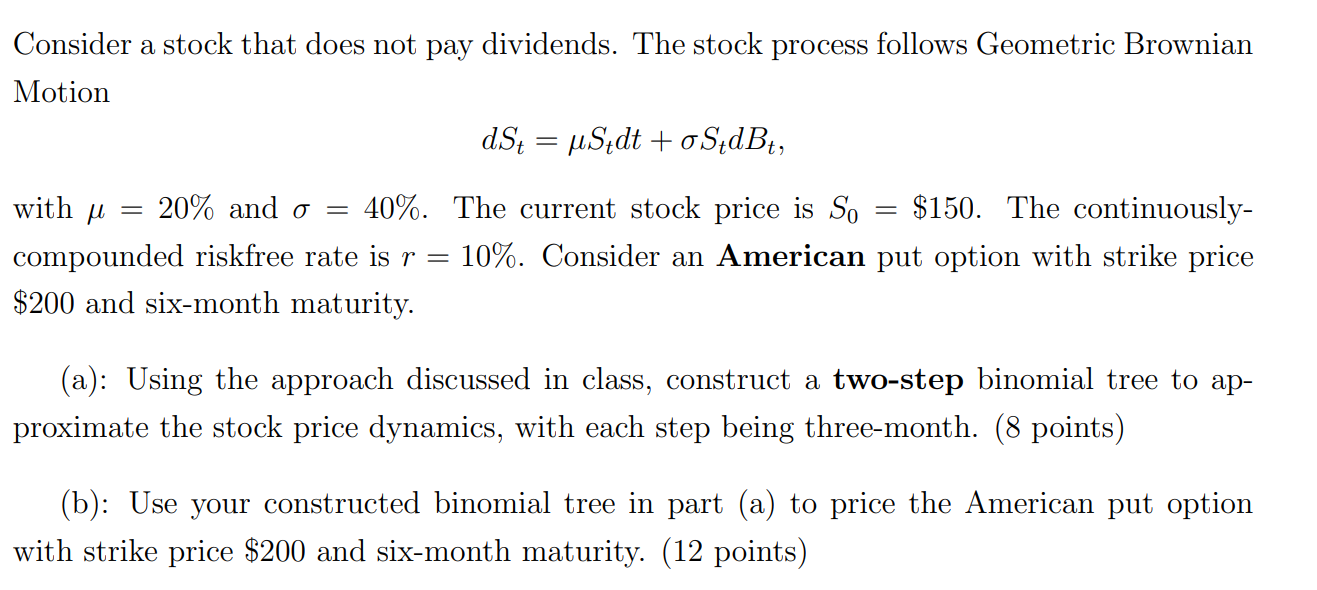

Consider a stock that does not pay dividends. The stock process follows Geometric Brownian Motion dSt = u Stdt + o StdBt, with u 20% and o 40%. The current stock price is So $150. The continuously- compounded riskfree rate is r = 10%. Consider an American put option with strike price $200 and six-month maturity. (a): Using the approach discussed in class, construct a two-step binomial tree to ap- proximate the stock price dynamics, with each step being three-month. (8 points) (b): Use your constructed binomial tree in part (a) to price the American put option with strike price $200 and six-month maturity. (12 points) Consider a stock that does not pay dividends. The stock process follows Geometric Brownian Motion dSt = u Stdt + o StdBt, with u 20% and o 40%. The current stock price is So $150. The continuously- compounded riskfree rate is r = 10%. Consider an American put option with strike price $200 and six-month maturity. (a): Using the approach discussed in class, construct a two-step binomial tree to ap- proximate the stock price dynamics, with each step being three-month. (8 points) (b): Use your constructed binomial tree in part (a) to price the American put option with strike price $200 and six-month maturity. (12 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts