Question: Consider a stock whose price at time t is S(t) and which has constant volatility = 18%. The risk free rate is rf =

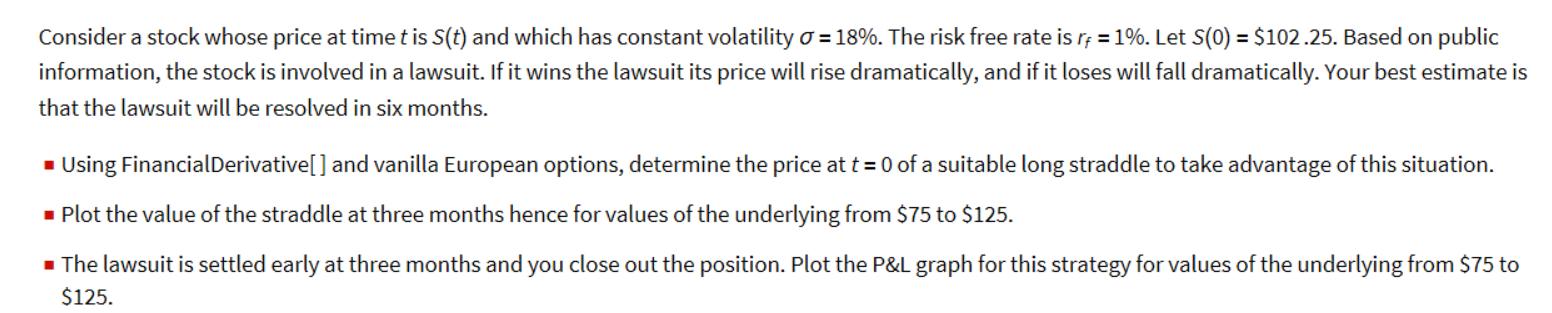

Consider a stock whose price at time t is S(t) and which has constant volatility = 18%. The risk free rate is rf = 1%. Let S(0) = $102.25. Based on public information, the stock is involved in a lawsuit. If it wins the lawsuit its price will rise dramatically, and if it loses will fall dramatically. Your best estimate is that the lawsuit will be resolved in six months. Using FinancialDerivative[] and vanilla European options, determine the price at t = 0 of a suitable long straddle to take advantage of this situation. Plot the value of the straddle at three months hence for values of the underlying from $75 to $125. The lawsuit is settled early at three months and you close out the position. Plot the P&L graph for this strategy for values of the underlying from $75 to $125.

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

To determine the price of a suitable long straddle at t 0 we can use the FinancialDerivative function in Mathematica The long straddle involves buying ... View full answer

Get step-by-step solutions from verified subject matter experts