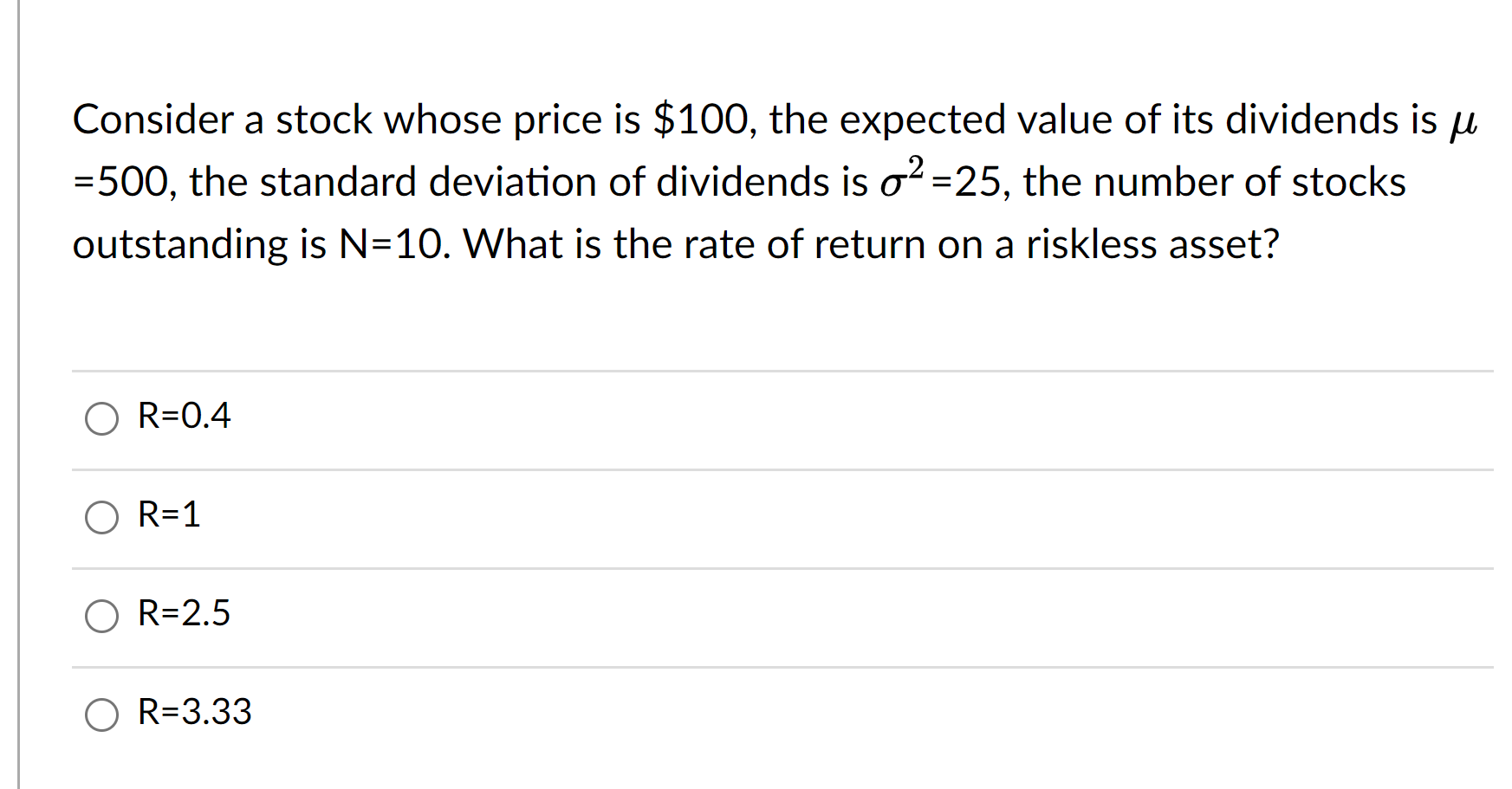

Question: Consider a stock whose price is $100, the expected value of its dividends is u =500, the standard deviation of dividends is 02 =25, the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock