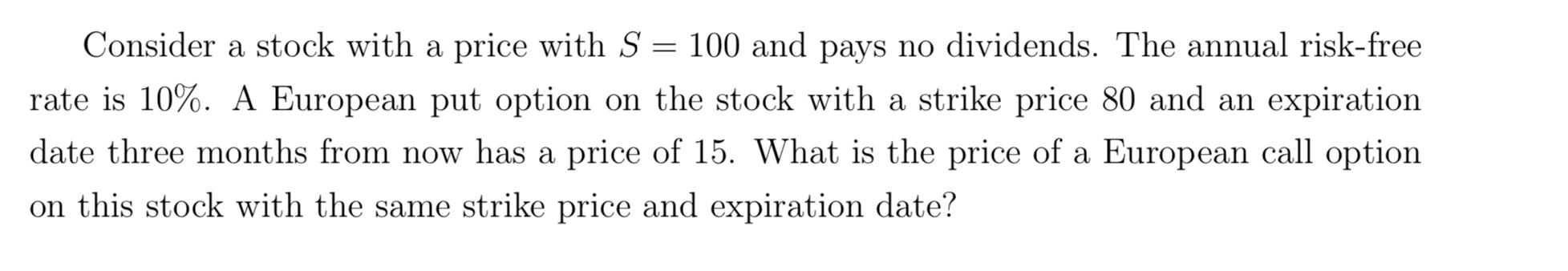

Question: = Consider a stock with a price with S = 100 and pays no dividends. The annual risk-free rate is 10%. A European put option

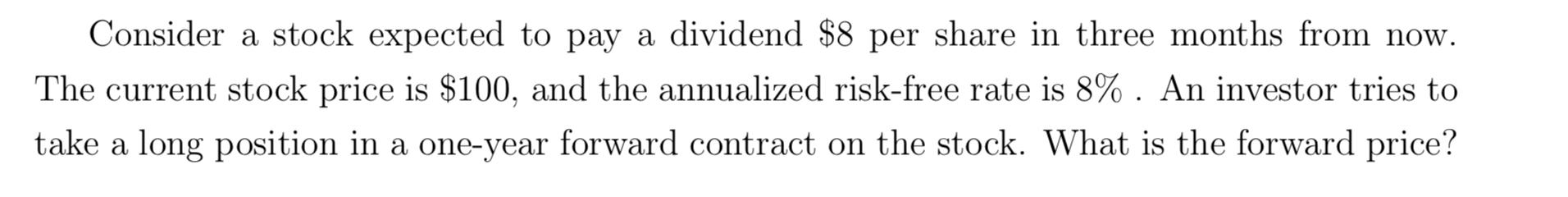

= Consider a stock with a price with S = 100 and pays no dividends. The annual risk-free rate is 10%. A European put option on the stock with a strike price 80 and an expiration date three months from now has a price of 15. What is the price of a European call option on this stock with the same strike price and expiration date? a Consider a stock expected to pay a dividend $8 per share in three months from now. The current stock price is $100, and the annualized risk-free rate is 8% . An investor tries to take a long position in a one-year forward contract on the stock. What is the forward price? a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock