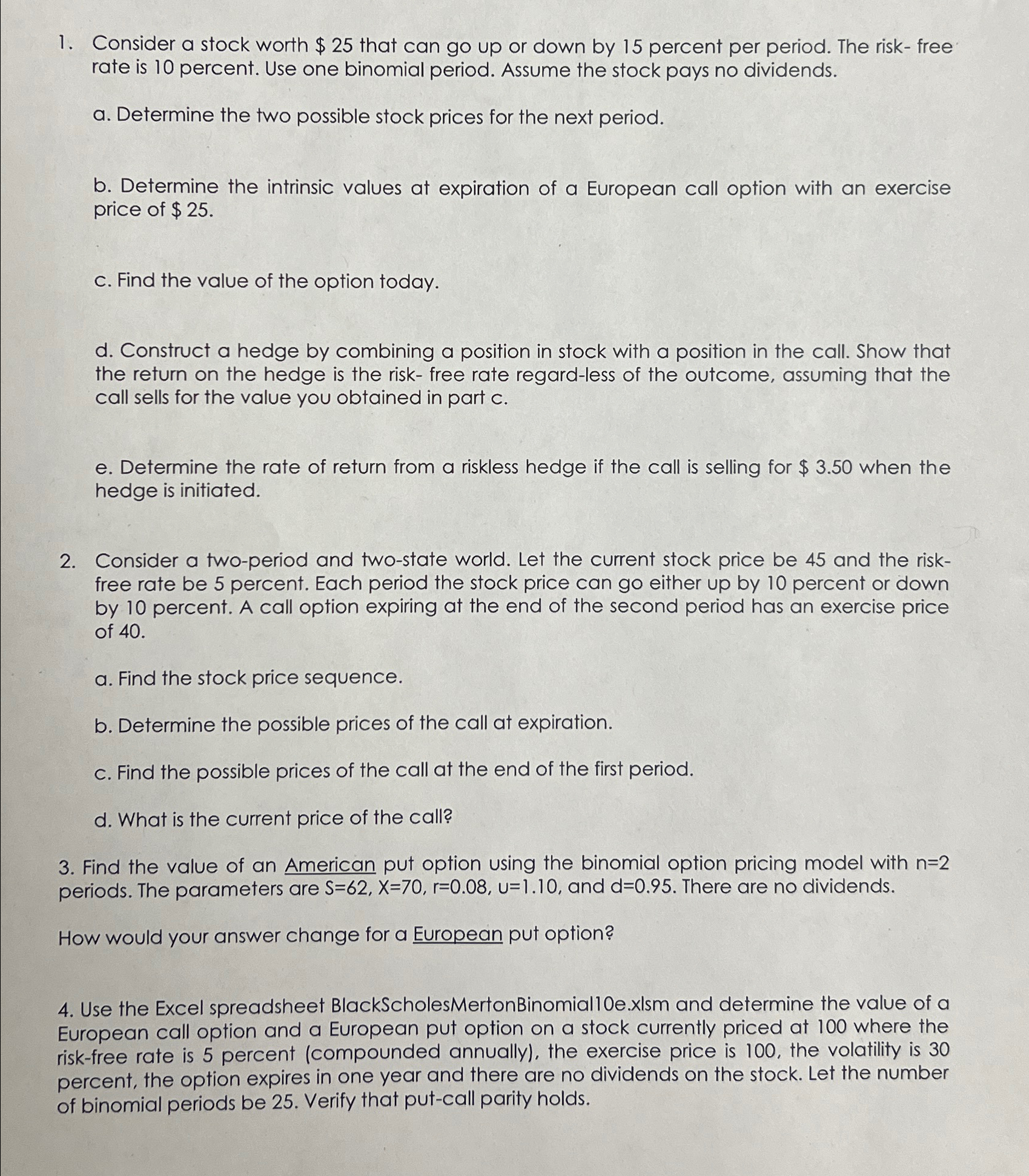

Question: Consider a stock worth $ 2 5 that can go up or down by 1 5 percent per period. The risk - free rate is

Consider a stock worth $ that can go up or down by percent per period. The riskfree rate is percent. Use one binomial period. Assume the stock pays no dividends.

a Determine the two possible stock prices for the next period.

b Determine the intrinsic values at expiration of a European call option with an exercise price of $

c Find the value of the option today.

d Construct a hedge by combining a position in stock with a position in the call. Show that the return on the hedge is the risk free rate regardless of the outcome, assuming that the call sells for the value you obtained in part

e Determine the rate of return from a riskless hedge if the call is selling for $ when the hedge is initiated.

Consider a twoperiod and twostate world. Let the current stock price be and the riskfree rate be percent. Each period the stock price can go either up by percent or down by percent. A call option expiring at the end of the second period has an exercise price of

a Find the stock price sequence.

b Determine the possible prices of the call at expiration.

c Find the possible prices of the call at the end of the first period.

d What is the current price of the call?

Find the value of an American put option using the binomial option pricing model with periods. The parameters are and There are no dividends.

How would your answer change for a European put option?

Use the Excel spreadsheet BlackScholesMertonBinomialexlsm and determine the value of a European call option and a European put option on a stock currently priced at where the riskfree rate is percent compounded annually the exercise price is the volatility is percent, the option expires in one year and there are no dividends on the stock. Let the number of binomial periods be Verify that putcall parity holds.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock