Question: Consider a stylized model describing how John Deere ( JD ) and Caterpillar ( C ) produce tractors for sale. Both JD and (

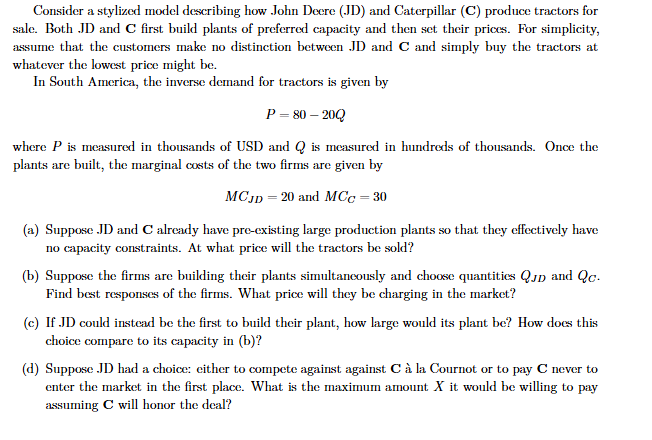

Consider a stylized model describing how John Deere JD and Caterpillar C produce tractors for sale. Both JD and mathbfC first build plants of preferred capacity and then set their prices. For simplicity, assume that the customers make no distinction between JD and mathbfC and simply buy the tractors at whatever the lowest price might be

In South America, the inverse demand for tractors is given by

P Q

where P is measured in thousands of USD and Q is measured in hundreds of thousands. Once the plants are built, the marginal costs of the two firms are given by

M CJ Dtext and M CC

a Suppose JD and mathbfC already have preexisting large production plants so that they effectively have no capacity constraints. At what price will the tractors be sold?

b Suppose the firms are building their plants simultaneously and choose quantities QJ D and QC Find best responses of the firms. What price will they be charging in the market?

c If JD could instead be the first to build their plant, how large would its plant be How does this choice compare to its capacity in b

d Suppose JD had a choice: either to compete against against mathbfC la Cournot or to pay mathbfC never to enter the market in the first place. What is the maximum amount X it would be willing to pay assuming mathbfC will honor the deal?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock