Question: Consider a three-year 10% coupon bond with a face value of $100. Suppose that the yield on the bond is 9% per annum with continuous

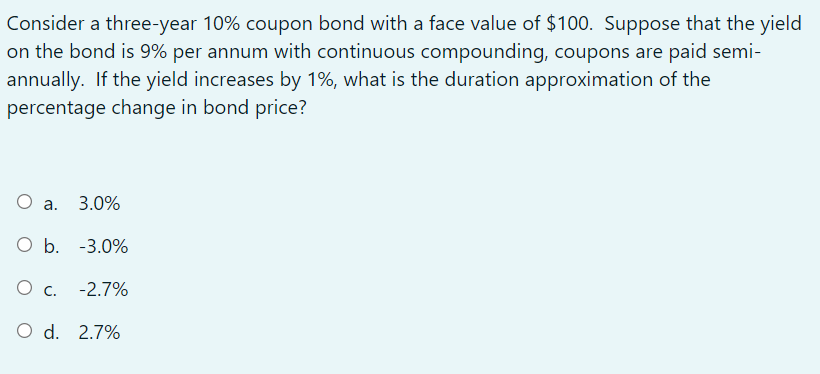

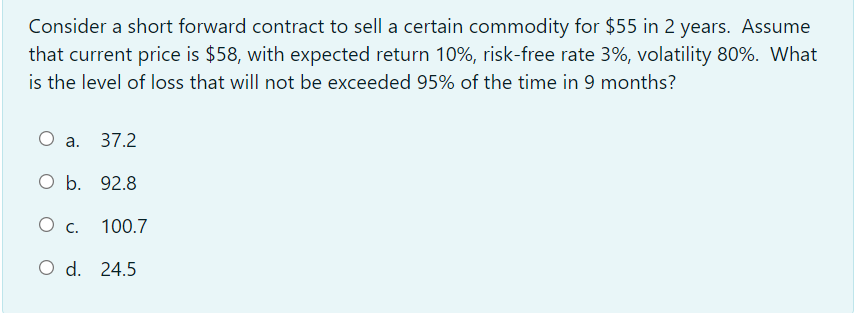

Consider a three-year 10% coupon bond with a face value of $100. Suppose that the yield on the bond is 9% per annum with continuous compounding, coupons are paid semi- annually. If the yield increases by 1%, what is the duration approximation of the percentage change in bond price? O a. 3.0% O b. -3.0% O c. -2.7% O d. 2.7% Consider a short forward contract to sell a certain commodity for $55 in 2 years. Assume that current price is $58, with expected return 10%, risk-free rate 3%, volatility 80%. What is the level of loss that will not be exceeded 95% of the time in 9 months? a. 37.2 O b. 92.8 O c. 100.7 O d. 24.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts