Question: Consider a trinomial tree for the Ho-Lee model where o =0.02. The initial zero-coupon interest rate for maturities of 0.5, 1.0, and 1.5 years are

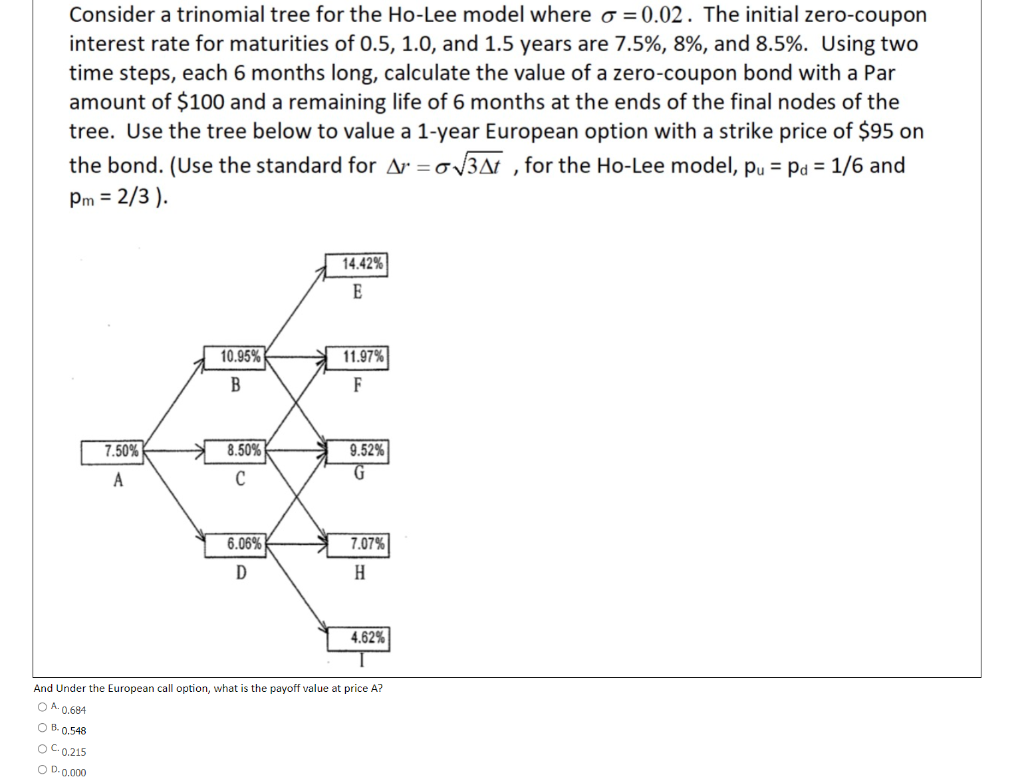

Consider a trinomial tree for the Ho-Lee model where o =0.02. The initial zero-coupon interest rate for maturities of 0.5, 1.0, and 1.5 years are 7.5%, 8%, and 8.5%. Using two time steps, each 6 months long, calculate the value of a zero-coupon bond with a Par amount of $100 and a remaining life of 6 months at the ends of the final nodes of the tree. Use the tree below to value a 1-year European option with a strike price of $95 on the bond. (Use the standard for Ar = ov3A4 , for the Ho-Lee model, pu = Pa = 1/6 and Pm = 2/3). =O 14.42% E 10.95% 11.97% B F 7.50% 8.50% 9.52% G A 6.06% D 7.07% H 4.62% And Under the European call option, what is the payoff value price A? OA.0.684 OB. 0.548 O.0.215 OD.0.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts