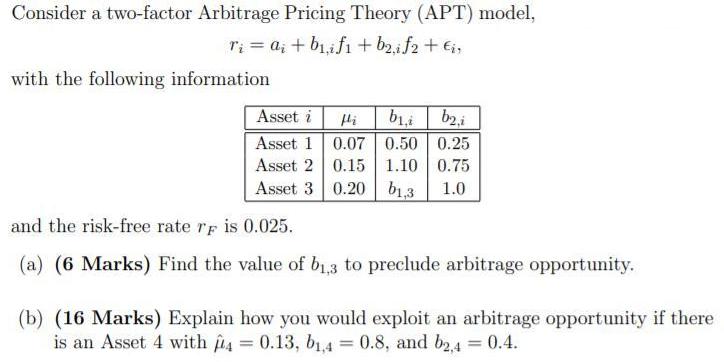

Question: Consider a two-factor Arbitrage Pricing Theory (APT) model, ri= a + bifi + b2.if2 + , with the following information Asset i Asset 1

Consider a two-factor Arbitrage Pricing Theory (APT) model, ri= a + bifi + b2.if2 + , with the following information Asset i Asset 1 Asset 2 b1,b2,i 0.07 0.50 0.25 0.15 1.10 0.75 Asset 3 0.20 1,3 1.0 and the risk-free rate rp is 0.025. (a) (6 Marks) Find the value of b1,3 to preclude arbitrage opportunity. (b) (16 Marks) Explain how you would exploit an arbitrage opportunity if there is an Asset 4 with 4 = 0.13, b1,4 = 0.8, and b2,4 = 0.4.

Step by Step Solution

3.61 Rating (155 Votes )

There are 3 Steps involved in it

a We know that there is no arbitrage opportunity if and only if the following equation h... View full answer

Get step-by-step solutions from verified subject matter experts