Question: Consider a two-period binomial model for an American call option on a stock index. You are given: (i) The current stock index price is

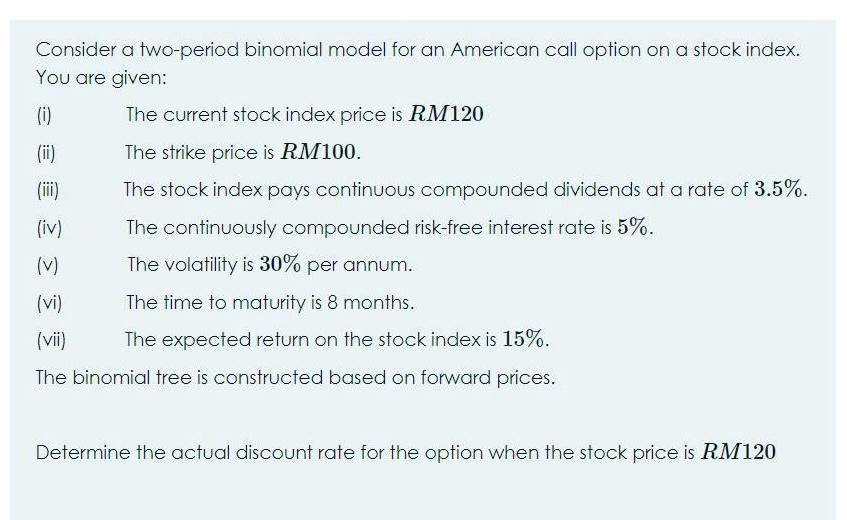

Consider a two-period binomial model for an American call option on a stock index. You are given: (i) The current stock index price is RM120. (ii) The strike price is RM100. (iii) The stock index pays continuous compounded dividends at a rate of 3.5%. (iv) The continuously compounded risk-free interest rate is 5%. (v) The volatility is 30% per annum. (vi) The time to maturity is 8 months. (vii) The expected return on the stock index is 15%. The binomial tree is constructed based on forward prices. Determine the actual discount rate for the option when the stock price is RM120

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

To determine the actual discount rate for the option when the stock price is RM120 we need to calcul... View full answer

Get step-by-step solutions from verified subject matter experts