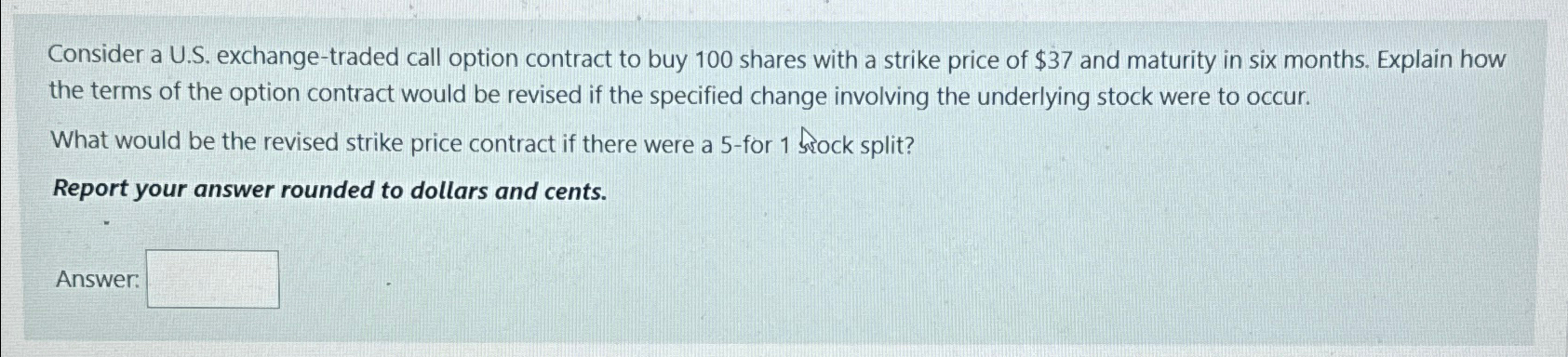

Question: Consider a U . S . exchange - traded call option contract to buy 1 0 0 shares with a strike price of $ 3

Consider a US exchangetraded call option contract to buy shares with a strike price of $ and maturity in six months. Explain how the terms of the option contract would be revised if the specified change involving the underlying stock were to occur.

What would be the revised strike price contract if there were a for sock split?

Report your answer rounded to dollars and cents.

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock