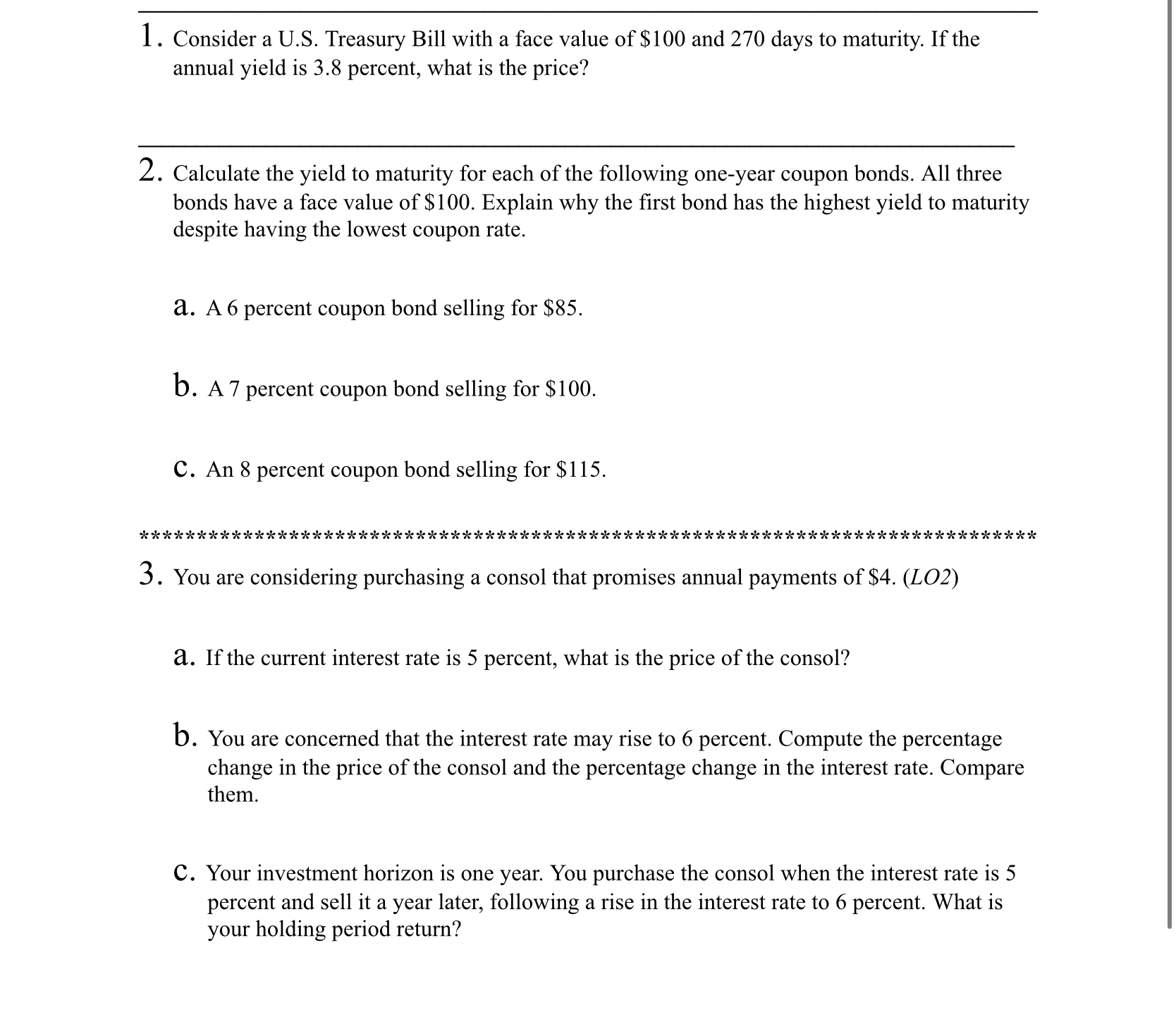

Question: Consider a U . S . Treasury Bill with a face value of $ 1 0 0 and 2 7 0 days to maturity. If

Consider a US Treasury Bill with a face value of $ and days to maturity. If the

annual yield is percent, what is the price?

Calculate the yield to maturity for each of the following oneyear coupon bonds. All three

bonds have a face value of $ Explain why the first bond has the highest yield to maturity

despite having the lowest coupon rate.

a A percent coupon bond selling for $

b A percent coupon bond selling for $

C An percent coupon bond selling for $

You are considering purchasing a consol that promises annual payments of $LO

a If the current interest rate is percent, what is the price of the consol?

b You are concerned that the interest rate may rise to percent. Compute the percentage

change in the price of the consol and the percentage change in the interest rate. Compare

them.

C Your investment horizon is one year. You purchase the consol when the interest rate is

percent and sell it a year later, following a rise in the interest rate to percent. What is

your holding period return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock