Question: Consider a world in which there are only two dates: 0 and 1. At date 1 there are three possible states of nature: a good

Consider a world in which there are only two dates: 0 and 1. At date 1 there are three possible states of nature: a good weather state (G), a fair weather state (F), and a bad weather state (B). Denote S1 as the set of these states, i.e., s1 ? S1 = {G,F,B}. The state at date zero is known. Denote probabilities of the three states as ? = (0.4, 0.3, 0.3).

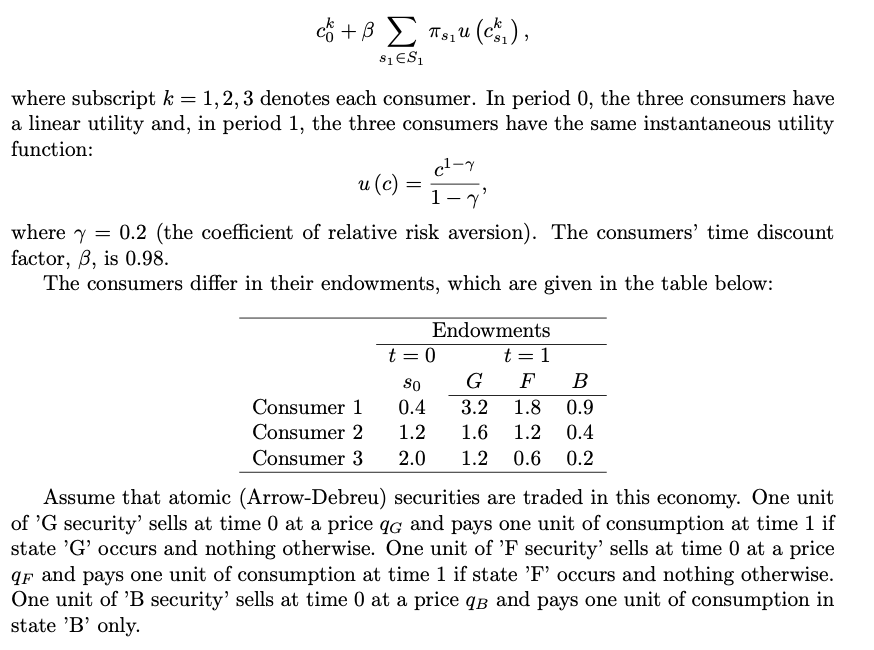

There is one non-storable consumption good, apple. There are three consumers in this economy. Their preferences over apples are exactly the same and are given by the following expected utility function

where subscript k = 1, 2, 3 denotes each consumer. In period 0, the three consumers have a linear utility and, in period 1, the three consumers have the same instantaneous utility function: cl\"? \"(6) = 1 '}', where 7 = 0.2 (the coefcient of relative risk aversion). The consumers' time discount factor, ,6, is 0.93. The consumers dier in their endowments, which are given in the table below: Endowments t = 0 t = 1 8|] G F B Consumer 1 0.4 3.2 1.8 0.9 Consumer 2 1.2 1.6 1.2 0.4 Consumer 3 2.0 1.2 0.6 0.2 Assume that atomic (Arrow-Debreu) securities are traded in this economy. One unit of 'G security' sells at time 0 at a price :39 and pays one unit of consumption at time 1 if state 'G' occurs and nothing otherwise. One unit of 'F security' sells at time 0 at a price {11: and pays one unit of consumption at time 1 if state 'F' occurs and nothing otherwise. One unit of 'B security' sells at time 0 at a price Q}; and pays one unit of consumption in state 'B' only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts