Question: Consider a world in which there are only two risky assets, A and B, and a risk-free asset F. The risky assets are in equal

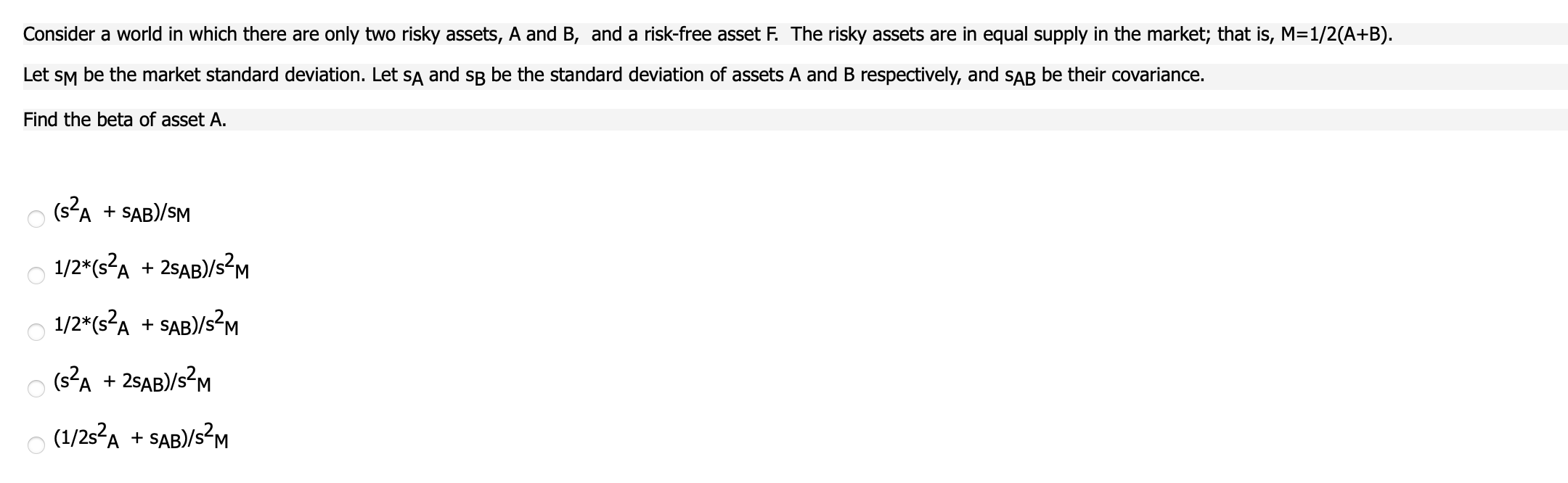

Consider a world in which there are only two risky assets, A and B, and a risk-free asset F. The risky assets are in equal supply in the market; that is, M=1/2(A+B). Let SM be the market standard deviation. Let sA and so be the standard deviation of assets A and B respectively, and SAB be their covariance. Find the beta of asset A. (sA + SAB)/SM 1/2*(s2A + 2SAB)/s2M 1/2*(S2A + SAB)/s? (S2A + 2SAB)/SM (1/282A + SAB)/s?M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts