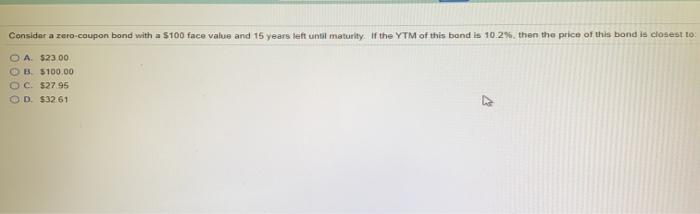

Question: Consider a zero-coupon bond with a $100 face value and 15 years left until maturity. If the YTM of this band is 102%. then the

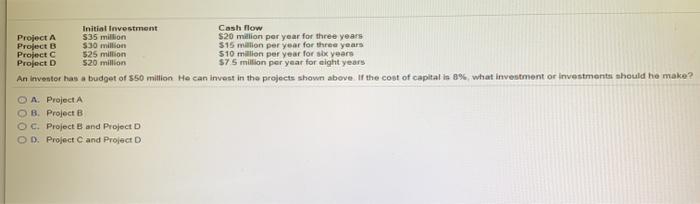

Consider a zero-coupon bond with a $100 face value and 15 years left until maturity. If the YTM of this band is 102%. then the price of this bond is closest to O A $23.00 OB $100.00 O.C. $27.95 D$3261 v Initial Investment Cash Flow Project A $35 million $20 million per year for three years Project B $30 million $15 million per year for three years Project 525 million $10 million per year for six years Project D 520 million S7.5 million per year for eight years An inventor has a budget of $50 million He can invest in the projects shown above. If the cost of capital in 8%, what investment or investments should he make? O A. Project OB. Project B c. Project and Project D OD. Project C and Project D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts