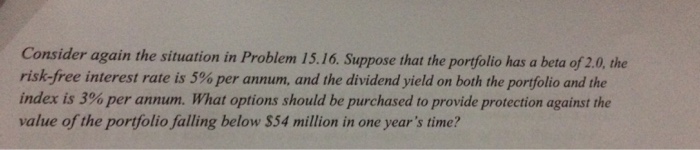

Question: Consider again the situation in Problem 15.16. Suppose that the portfolio has a beta of 2 0, the risk-free interest rate is 5% per annum,

Consider again the situation in Problem 15.16. Suppose that the portfolio has a beta of 2 0, the risk-free interest rate is 5% per annum, and the dividend yield on both the portfolio and the index is 3% per annum. What options should be purchased to provide protection against the value of the portfolio falling below 554 million in one year's time? Consider again the situation in Problem 15.16. Suppose that the portfolio has a beta of 2 0, the risk-free interest rate is 5% per annum, and the dividend yield on both the portfolio and the index is 3% per annum. What options should be purchased to provide protection against the value of the portfolio falling below 554 million in one year's time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts