Question: Consider an agent with the following utility function: U = E(rp) 0.005A Consider that this agent wants to create an efficient portfolio and that

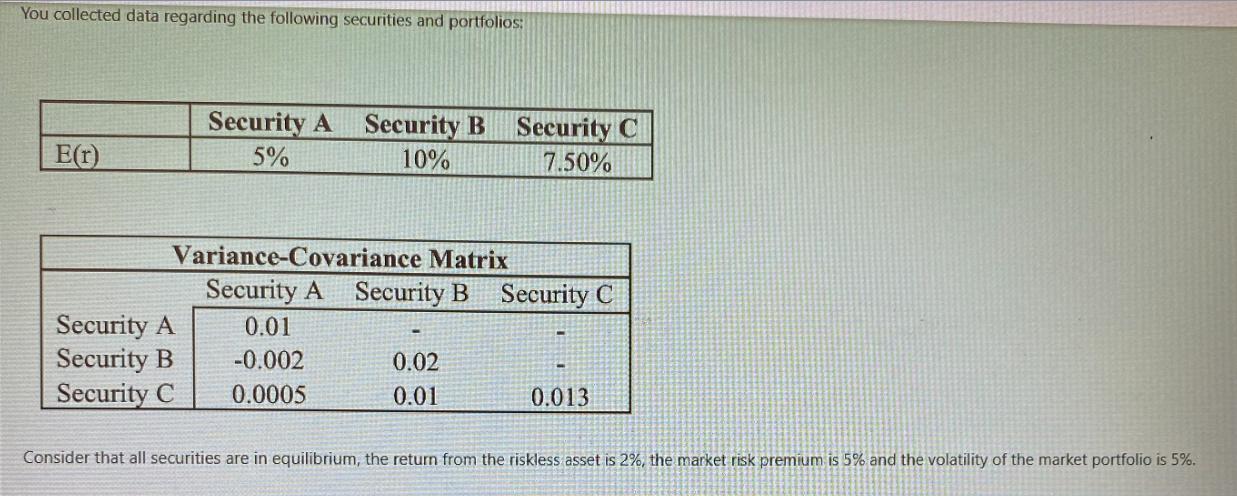

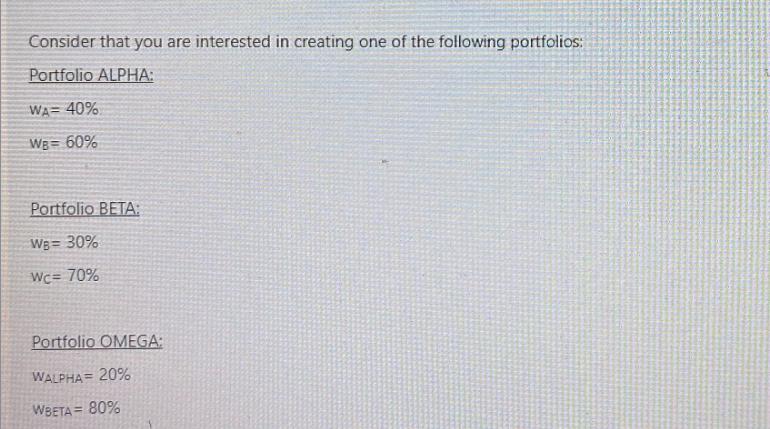

Consider an agent with the following utility function: U = E(rp) 0.005A Consider that this agent wants to create an efficient portfolio and that her coefficient of risk aversion is 25. Compute the expected return of this portfolio. You collected data regarding the following securities and portfolios: E(r) Security A 5% Security B Security C 10% 7.50% Variance-Covariance Matrix Security A Security B Security C Security A Security B Security C 0.01 -0.002 0.02 0.0005 0.01 0.013 Consider that all securities are in equilibrium, the return from the riskless asset is 2%, the market risk premium is 5% and the volatility of the market portfolio is 5%. Consider that you are interested in creating one of the following portfolios: Portfolio ALPHA: WA= 40% WB= 60% Portfolio BETA: WB= 30% Wc= 70% Portfolio OMEGA: WALPHA 20% WBETA = 80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts