Question: Consider an investment project whose initial cost which is also equal to its capital cost is $30 million. The life of the project is 15

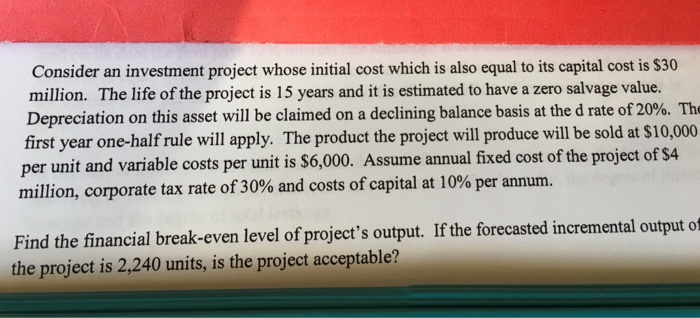

Consider an investment project whose initial cost which is also equal to its capital cost is $30 million. The life of the project is 15 years and it is estimated to have a zero salvage value. n on this asset will be claimed on a declining balance basis at the d rate of 20%. The first year one-half rule will apply. The product the project will produce will be sold at $10,000 per unit and variable costs per unit is $6,000. million, corporate tax rate of 30% and costs of capital at 10% per annum. Assume annual fixed cost of the project of $4 Find the financial break-even level of project's output. If the project is 2,240 units, is the project acceptable? the forecasted incremental output of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts