Question: Consider an investment whose annual return is normally distributed with a mean of 6% and a standard deviation of 14%. (a) What is the probability

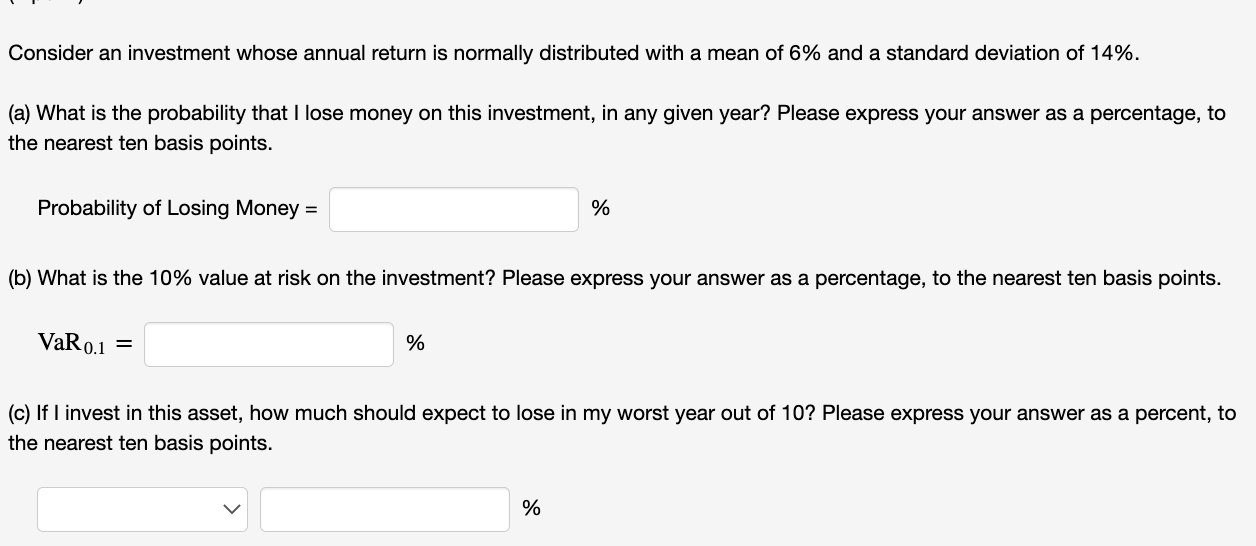

Consider an investment whose annual return is normally distributed with a mean of 6% and a standard deviation of 14%. (a) What is the probability that I lose money on this investment, in any given year? Please express your answer as a percentage, to the nearest ten basis points. Probability of Losing Money = % (b) What is the 10% value at risk on the investment? Please express your answer as a percentage, to the nearest ten basis points. VaR0.1=VaR0.1= % (c) If I invest in this asset, how much should expect to lose in my worst year out of 10? Please express your answer as a percent, to the nearest ten basis points. At Least Exactly No More Than %

Consider an investment whose annual return is normally distributed with a mean of 6% and a standard deviation of 14%. (a) What is the probability that I lose money on this investment, in any given year? Please express your answer as a percentage, to the nearest ten basis points. Probability of Losing Money = % (b) What is the 10% value at risk on the investment? Please express your answer as a percentage, to the nearest ten basis points. VaR0.1 = % (c) If I invest in this asset, how much should expect to lose in my worst year out of 10? Please express your answer as a percent, to the nearest ten basis points. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts