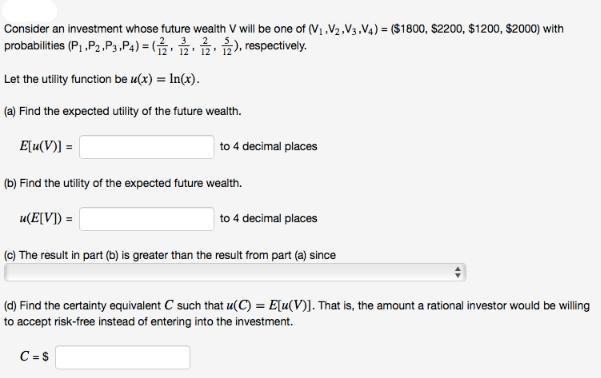

Question: Consider an investment whose future wealth V will be one of (V.V.V3.V4) = ($1800, $2200, $1200, $2000) with probabilities (P, P, P3, P4) =(2222),

Consider an investment whose future wealth V will be one of (V.V.V3.V4) = ($1800, $2200, $1200, $2000) with probabilities (P, P, P3, P4) =(2222), respectively. '12' 12 Let the utility function be u(x) = ln(x). (a) Find the expected utility of the future wealth. E[u(V)] = (b) Find the utility of the expected future wealth. u(E[V]) = (c) The result in part (b) is greater than the result from part (a) since to 4 decimal places to 4 decimal places (d) Find the certainty equivalent C such that u(C) = E[u(V)]. That is, the amount a rational investor would be willing to accept risk-free instead of entering into the investment. C=$

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To solve this problem well first calculate the expected utility of ... View full answer

Get step-by-step solutions from verified subject matter experts