Question: Consider an investor with utility given U = ln (7) This investor is facing a one-year investment opportunity that will have a cashflow next

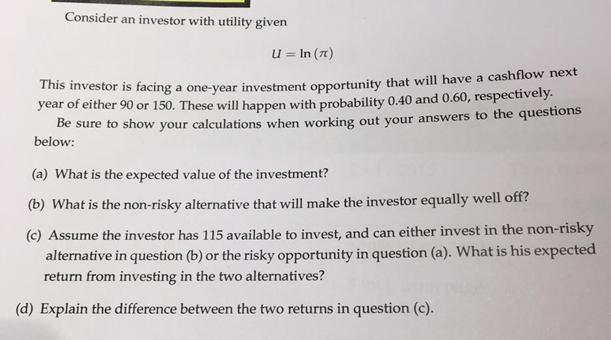

Consider an investor with utility given U = ln (7) This investor is facing a one-year investment opportunity that will have a cashflow next year of either 90 or 150. These will happen with probability 0.40 and 0.60, respectively. Be sure to show your calculations when working out your answers to the questions below: (a) What is the expected value of the investment? (b) What is the non-risky alternative that will make the investor equally well off? (c) Assume the investor has 115 available to invest, and can either invest in the non-risky alternative in question (b) or the risky opportunity in question (a). What is his expected return from investing in the two alternatives? (d) Explain the difference between the two returns in question (c).

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

a What is the expected value of the investment ANS WER The expected value of the investment is 120 WORK ING E X 90 x 0 40 150 x 0 60 36 90 120 EX PL A... View full answer

Get step-by-step solutions from verified subject matter experts