Question: Consider an n = 1 step binomial tree with T = .5. Suppose r, the annualized risk-free rate is 5 %, and delta, the

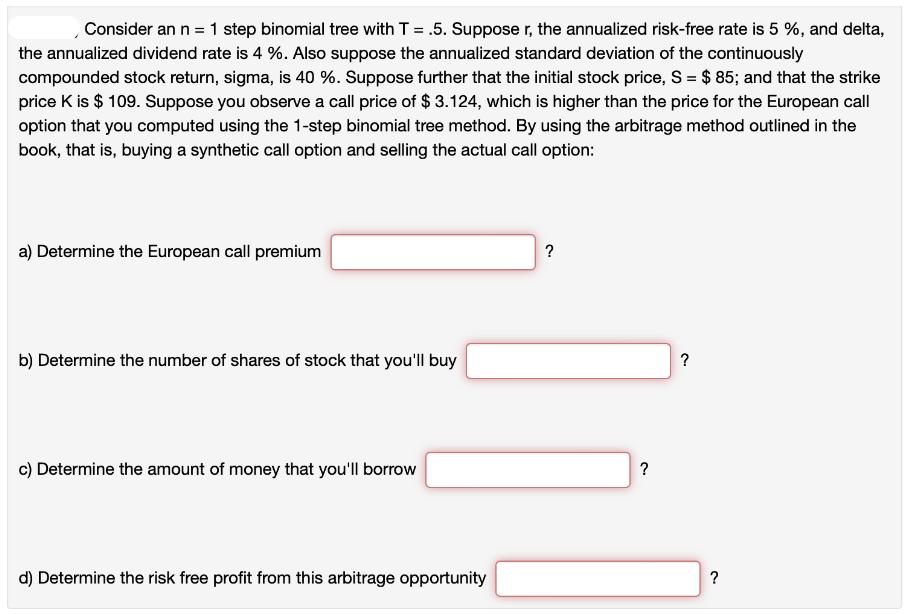

Consider an n = 1 step binomial tree with T = .5. Suppose r, the annualized risk-free rate is 5 %, and delta, the annualized dividend rate is 4 %. Also suppose the annualized standard deviation of the continuously compounded stock return, sigma, is 40 %. Suppose further that the initial stock price, S = $ 85; and that the strike price K is $ 109. Suppose you observe a call price of $ 3.124, which is higher than the price for the European call option that you computed using the 1-step binomial tree method. By using the arbitrage method outlined in the book, that is, buying a synthetic call option and selling the actual call option: a) Determine the European call premium b) Determine the number of shares of stock that you'll buy c) Determine the amount of money that you'll borrow d) Determine the risk free profit from this arbitrage opportunity ? ? ? ?

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step 1 Introduction of the option An American call option is a financial contract t... View full answer

Get step-by-step solutions from verified subject matter experts