Question: Consider company ABC whose stock pays an initial dividend per share next year of $30 and has expected dividend growth rate of 2% per

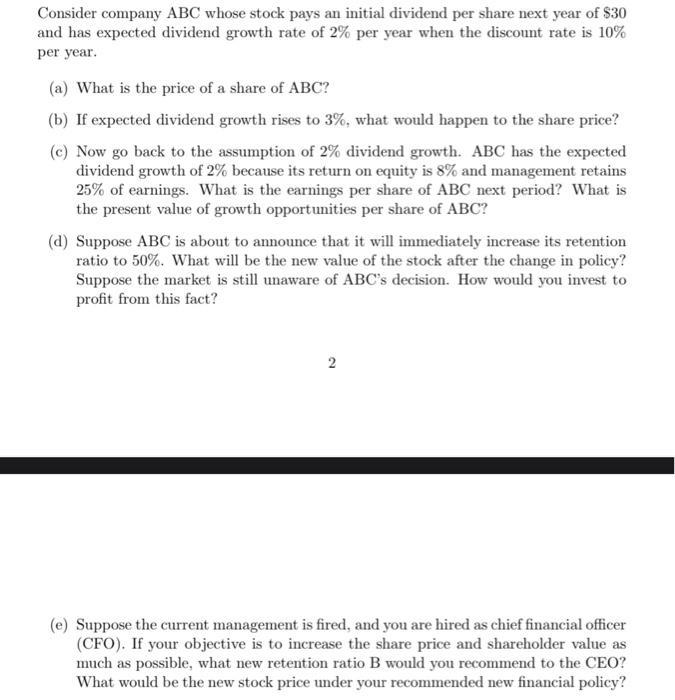

Consider company ABC whose stock pays an initial dividend per share next year of $30 and has expected dividend growth rate of 2% per year when the discount rate is 10% per year. (a) What is the price of a share of ABC? (b) If expected dividend growth rises to 3%, what would happen to the share price? (c) Now go back to the assumption of 2% dividend growth. ABC has the expected dividend growth of 2% because its return on equity is 8% and management retains 25% of earnings. What is the earnings per share of ABC next period? What is the present value of growth opportunities per share of ABC? (d) Suppose ABC is about to announce that it will immediately increase its retention ratio to 50%. What will be the new value of the stock after the change in policy? Suppose the market is still unaware of ABC's decision. How would you invest to profit from this fact? 2 (e) Suppose the current management is fired, and you are hired as chief financial officer (CFO). If your objective is to increase the share price and shareholder value as much as possible, what new retention ratio B would you recommend to the CEO? What would be the new stock price under your recommended new financial policy?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts