Question: Consider CPP and EI rate for 2021 1. Trax Ltd. has six employees, each of whom earns $3,000 per month. Income taxes are 20% of

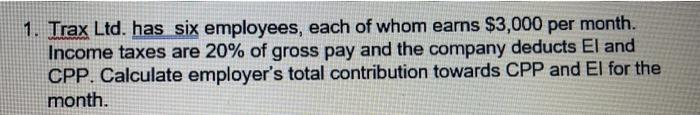

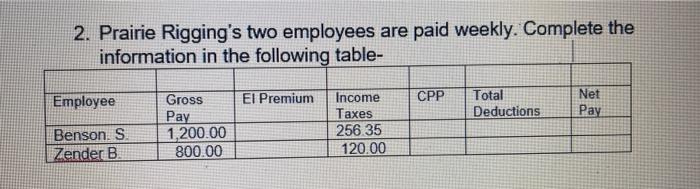

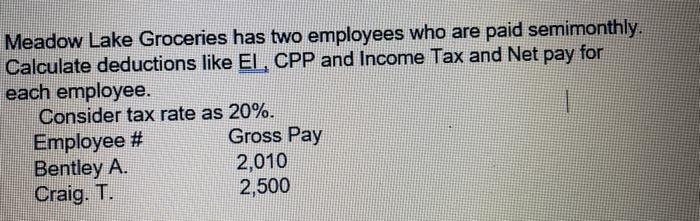

1. Trax Ltd. has six employees, each of whom earns $3,000 per month. Income taxes are 20% of gross pay and the company deducts El and CPP. Calculate employer's total contribution towards CPP and El for the month. 2. Prairie Rigging's two employees are paid weekly. Complete the information in the following table- Employee El Premium CPP Gross Pay Total Deductions Net Pay Income Taxes 256 35 120.00 Benson, S. Zender B 1,200.00 800.00 Meadow Lake Groceries has two employees who are paid semimonthly. Calculate deductions like El, CPP and Income Tax and Net pay for each employee. Consider tax rate as 20%. Employee # Gross Pay Bentley A. 2,010 Craig. T. 2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts