Question: Consider d=4 assets whose returns Ri are modelled with Sharp's single-index model with zero interest rates, with = a+B*RM +Ei, where Rm is the market

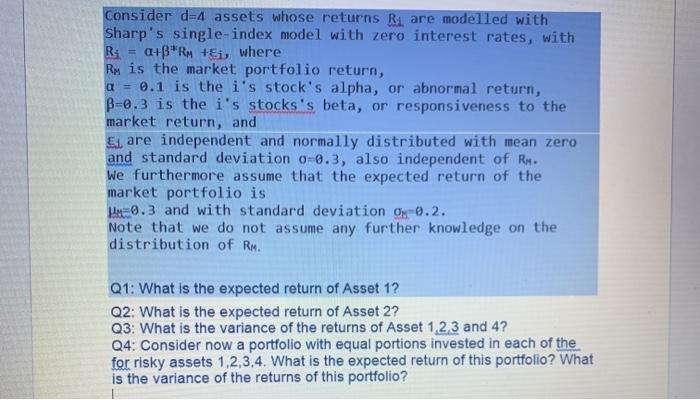

Consider d=4 assets whose returns Ri are modelled with Sharp's single-index model with zero interest rates, with = a+B*RM +Ei, where Rm is the market portfolio return, a = 0.1 is the i's stock's alpha, or abnormal return, B=0.3 is the i's stocks's beta, or responsiveness to the market return, and Ei are independent and normally distributed with mean zero and standard deviation 0-0.3, also independent of Rs. We furthermore assume that the expected return of the market portfolio is 0.3 and with standard deviation Ox0.2. Note that we do not assume any further knowledge on the distribution of RM. Q1: What is the expected return of Asset 1? Q2: What is the expected return of Asset 2? Q3: What is the variance of the returns of Asset 12.3 and 4? Q4: Consider now a portfolio with equal portions invested in each of the for risky assets 1,2,3,4. What is the expected return of this portfolio? What is the variance of the returns of this portfolio? Consider d=4 assets whose returns Ri are modelled with Sharp's single-index model with zero interest rates, with = a+B*RM +Ei, where Rm is the market portfolio return, a = 0.1 is the i's stock's alpha, or abnormal return, B=0.3 is the i's stocks's beta, or responsiveness to the market return, and Ei are independent and normally distributed with mean zero and standard deviation 0-0.3, also independent of Rs. We furthermore assume that the expected return of the market portfolio is 0.3 and with standard deviation Ox0.2. Note that we do not assume any further knowledge on the distribution of RM. Q1: What is the expected return of Asset 1? Q2: What is the expected return of Asset 2? Q3: What is the variance of the returns of Asset 12.3 and 4? Q4: Consider now a portfolio with equal portions invested in each of the for risky assets 1,2,3,4. What is the expected return of this portfolio? What is the variance of the returns of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts