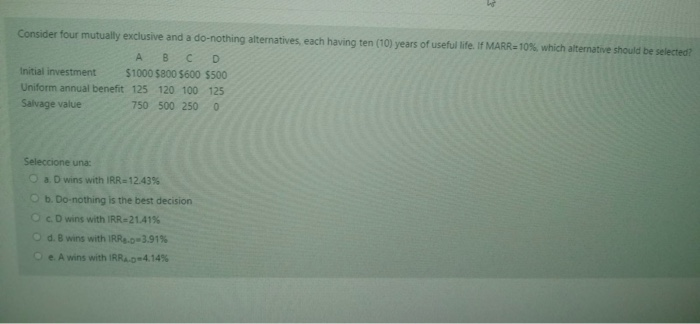

Question: Consider four mutually exclusive and a do-nothing alternatives, each having ten (10) years of useful life. If MARR=10%, which alternative should be selected? A B

Consider four mutually exclusive and a do-nothing alternatives, each having ten (10) years of useful life. If MARR=10%, which alternative should be selected? A B D Initial investment $1000 5800 5600 5500 Uniform annual benefit 125 120 100 125 Salvage value 750 500 250 0 Seleccione una a D wins with IRR-12.43% b. Do nothing is the best decision Oc wins with IRR-21.41% d. B wins with IRR.0-3.91% e. A wins with IRRA.4.14%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock