Question: Consider how Cherry Valley, a popular ski resort, could use capital budgeting to decide whether the S8 million Autumn Park Lodge expansion would be a

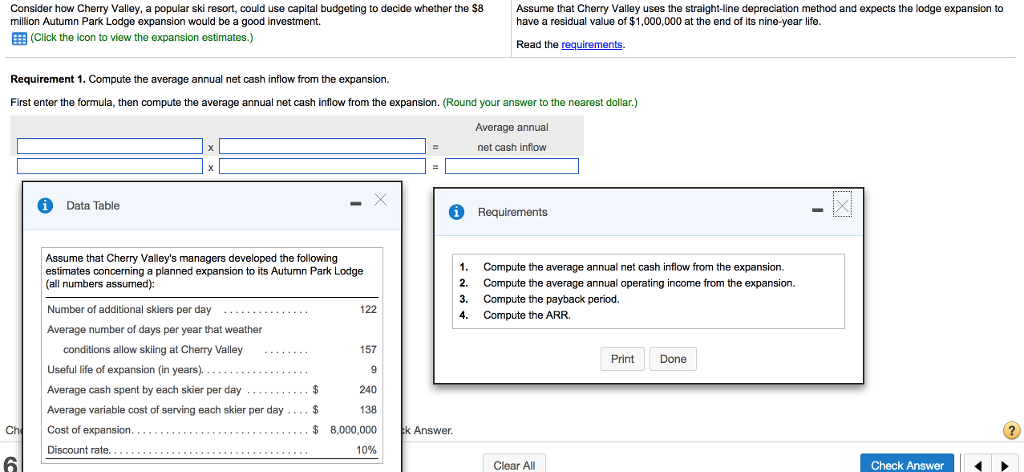

Consider how Cherry Valley, a popular ski resort, could use capital budgeting to decide whether the S8 million Autumn Park Lodge expansion would be a good investment. EEE (Click the icon to view the expansion estimates.) Assume that Cherry Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its nine-year life Read the requirements. Requirement 1. Compute the average a nnual net cash inflow from the expansion. First enter the formula, then compute the average annual net cash inflow from the expansion. (Round your answer to the nearest dollar.) Average annual net cash inflow Data Table Requirements Assume that Cherry Valley's managers developed the following estimates concerning a planned expansion to its Autumn Park Lodge (all numbers assumed): 1. Compute the average annual net cash inflow from the expansion. 2. Compute the average annual operating income from the expansion. 3. Compute the payback period. 4. Compute the ARR. Number of additional skiers per day 122 Average number of days per year that weather conditions allow skiing at Cherry Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day.$ 157 PrintDone 240 138 . . $8,000,000 10% Answer. Discount rate 6 Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts