Question: Consider how Steinback Valley Spring Park Lodge could use capital budgeting to decide whether the $12,000,000 Spring Park Lodge expansion would be a good investment

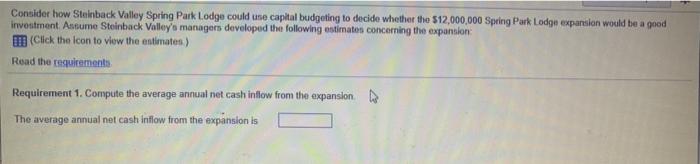

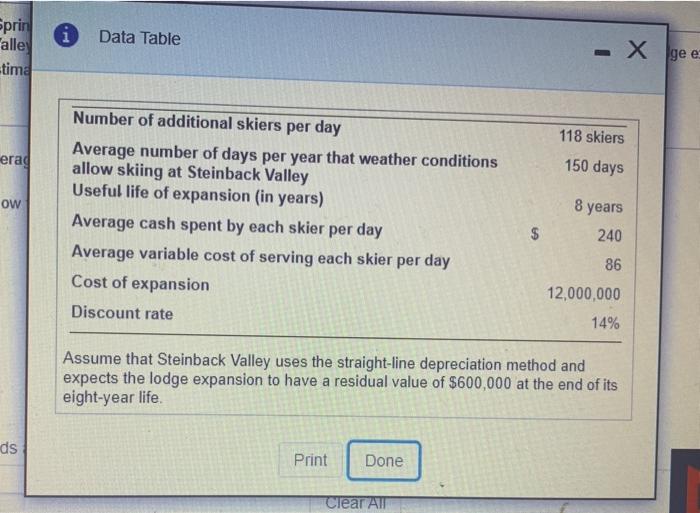

Consider how Steinback Valley Spring Park Lodge could use capital budgeting to decide whether the $12,000,000 Spring Park Lodge expansion would be a good investment Assume Steinback Valley's managers developed the following estimates concerning the expansion (Click the icon to view the estimates) Read the requirements Requirement 1. Compute the average annual net cash inflow from the expansion The average annual net cash inflow from the expansion is the averag Requirements ush inflow 1. Compute the average annual net cash inflow from the expansion. 2. Compute the average annual operating income from the expansion Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts