Question: Consider pricing a call option on the S&P 5 0 0 Index with the expiration date in 4 months and a strike price of $

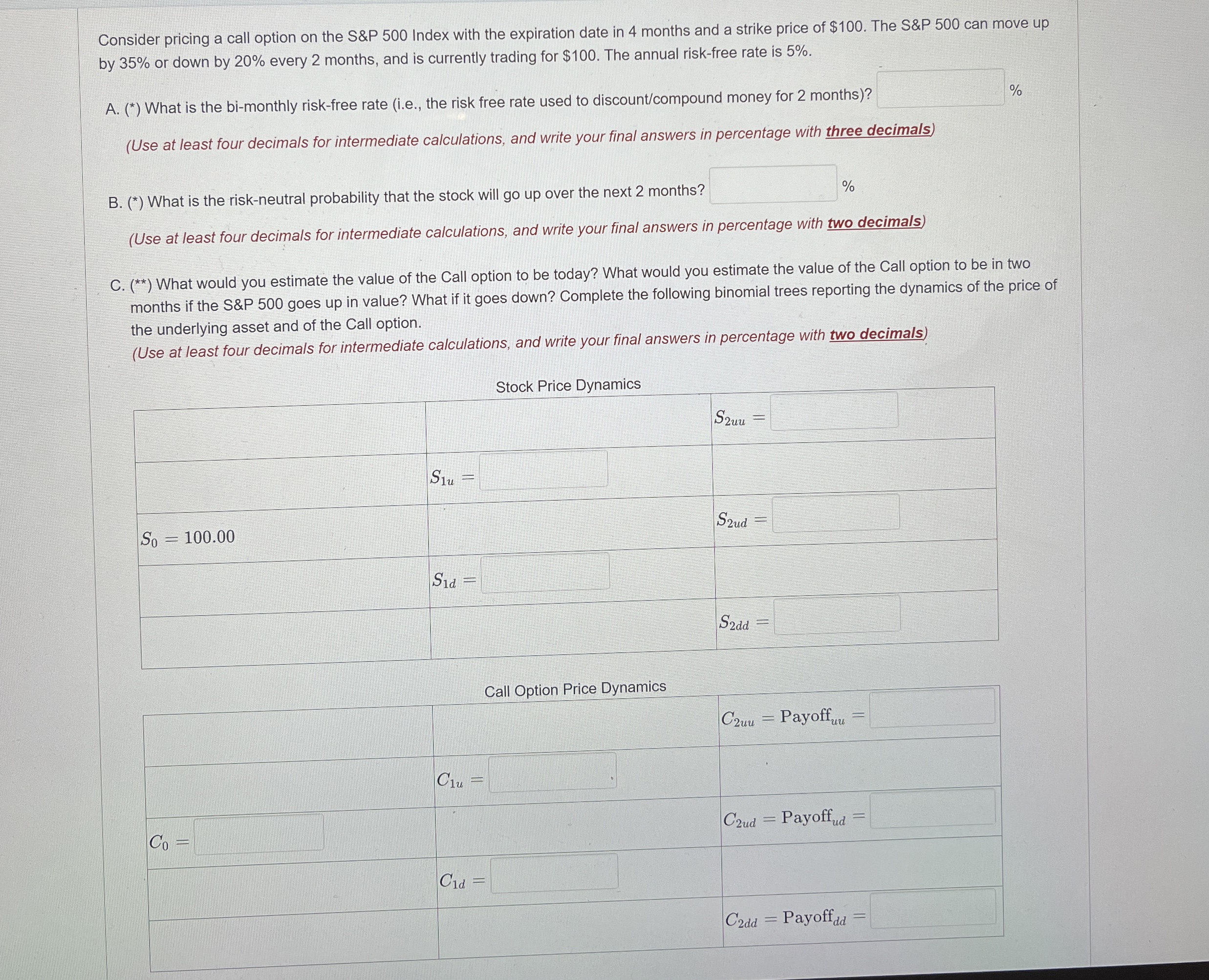

Consider pricing a call option on the S&P Index with the expiration date in months and a strike price of $ The S&P can move up

by or down by every months, and is currently trading for $ The annual riskfree rate is

A What is the bimonthly riskfree rate ie the risk free rate used to discountcompound money for months

Use at least four decimals for intermediate calculations, and write your final answers in percentage with three decimals

B What is the riskneutral probability that the stock will go up over the next months?

Use at least four decimals for intermediate calculations, and write your final answers in percentage with two decimals

C What would you estimate the value of the Call option to be today? What would you estimate the value of the Call option to be in two

months if the S&P goes up in value? What if it goes down? Complete the following binomial trees reporting the dynamics of the price of

the underlying asset and of the Call option.

Use at least four decimals for intermediate calculations, and write your final answers in percentage with two decimals

Call Option Price Dynamics

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock