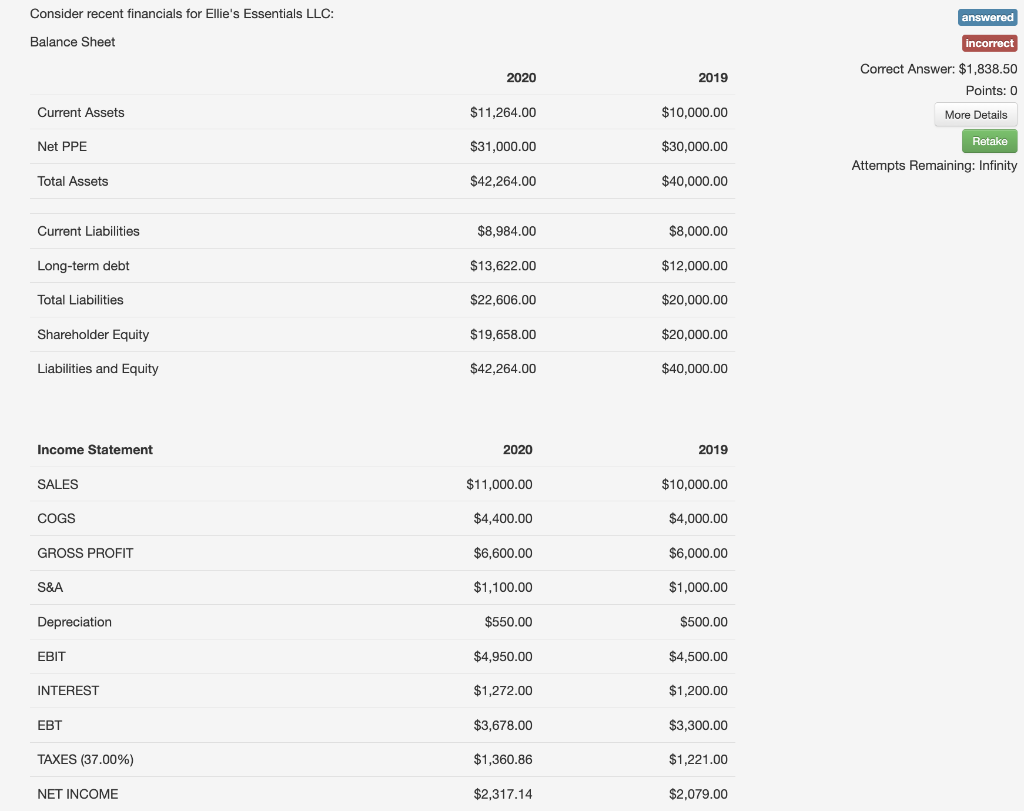

Question: Consider recent financials for Ellie's Essentials LLC: Balance Sheet Correct Answer: $1,838.50 Points: 0 Attempts Remaining: Infinity Going forward, analysts have forecasted the following free

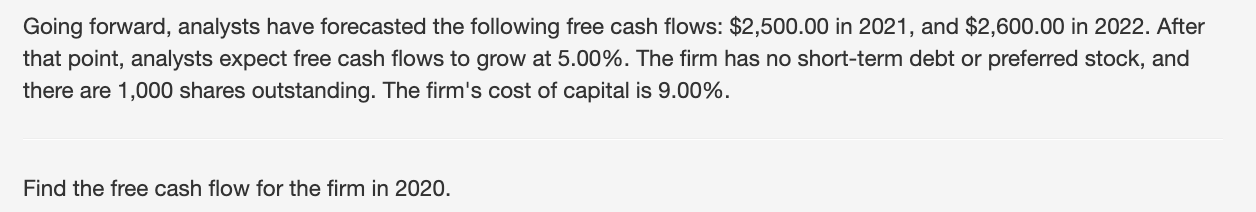

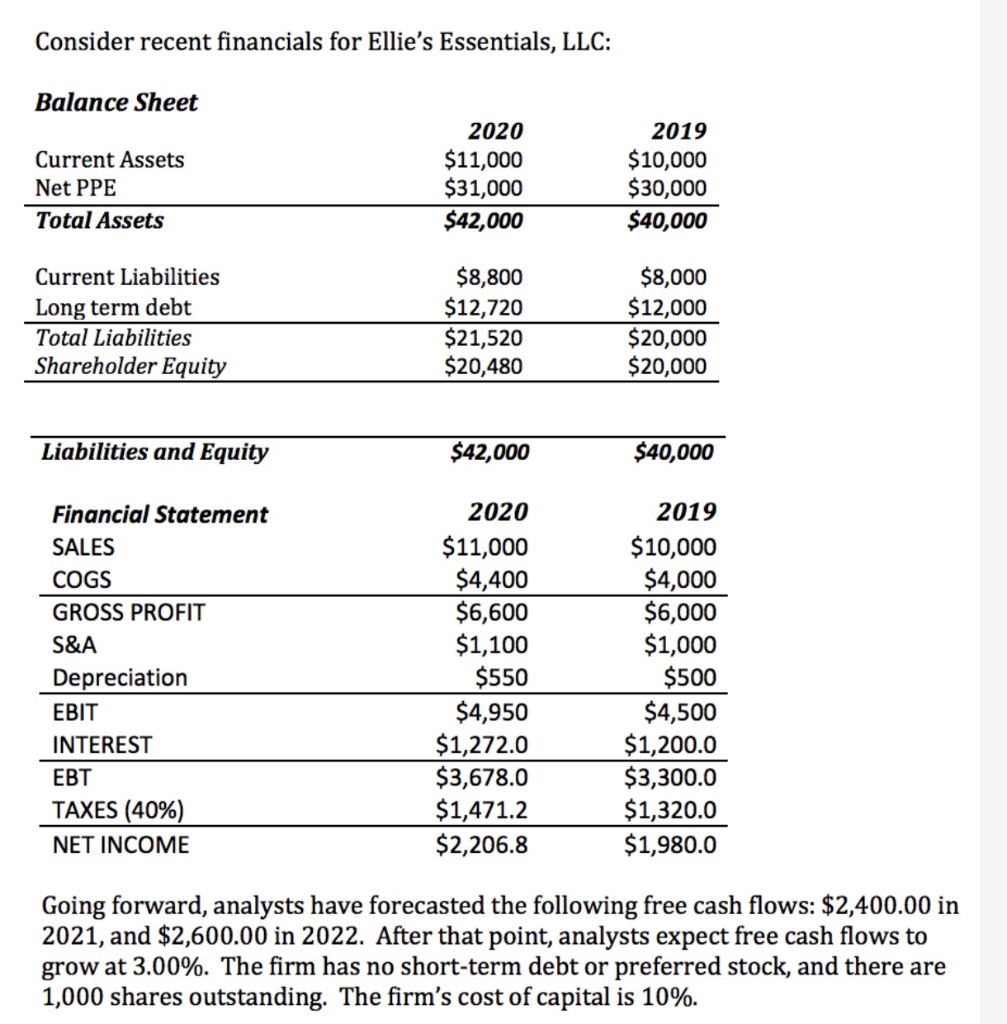

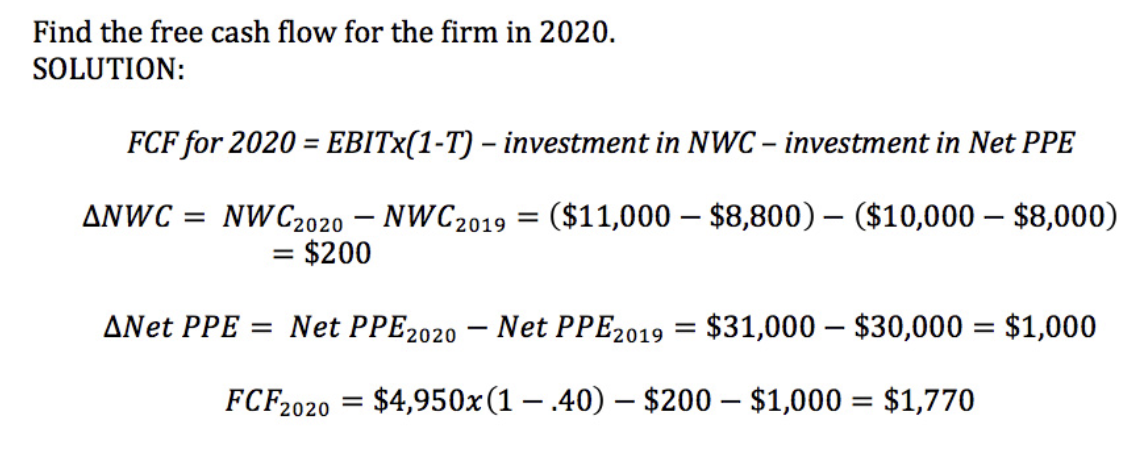

Consider recent financials for Ellie's Essentials LLC: Balance Sheet Correct Answer: $1,838.50 Points: 0 Attempts Remaining: Infinity Going forward, analysts have forecasted the following free cash flows: $2,500.00 in 2021 , and $2,600.00 in 2022 . After that point, analysts expect free cash flows to grow at 5.00\%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 9.00%. Find the free cash flow for the firm in 2020. Consider recent financials for Ellie's Essentials, LLC: Going forward, analysts have forecasted the following free cash flows: $2,400.00 in 2021 , and $2,600.00 in 2022. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 10%. Find the free cash flow for the firm in 2020 . SOLUTION: FCF for 2020=EBITx(1T) investment in NWC - investment in Net PPE NWC=NWC2020NWC2019=($11,000$8,800)($10,000$8,000)=$200NetPPE=NetPPE2020NetPPE2019=$31,000$30,000=$1,000FCF2020=$4,950x(1.40)$200$1,000=$1,770 Consider recent financials for Ellie's Essentials LLC: Balance Sheet Correct Answer: $1,838.50 Points: 0 Attempts Remaining: Infinity Going forward, analysts have forecasted the following free cash flows: $2,500.00 in 2021 , and $2,600.00 in 2022 . After that point, analysts expect free cash flows to grow at 5.00\%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 9.00%. Find the free cash flow for the firm in 2020. Consider recent financials for Ellie's Essentials, LLC: Going forward, analysts have forecasted the following free cash flows: $2,400.00 in 2021 , and $2,600.00 in 2022. After that point, analysts expect free cash flows to grow at 3.00%. The firm has no short-term debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 10%. Find the free cash flow for the firm in 2020 . SOLUTION: FCF for 2020=EBITx(1T) investment in NWC - investment in Net PPE NWC=NWC2020NWC2019=($11,000$8,800)($10,000$8,000)=$200NetPPE=NetPPE2020NetPPE2019=$31,000$30,000=$1,000FCF2020=$4,950x(1.40)$200$1,000=$1,770

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts