Question: Assume you purchase the March 2023, X = 55 put option on 9/15/2022 (5 contracts). If you had unwound your option position on 11/15/2022, what

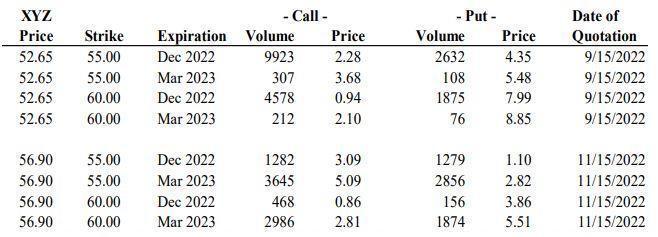

Assume you purchase the March 2023, X = 55 put option on 9/15/2022 (5 contracts). If you had unwound your option position on 11/15/2022, what would your total dollar return be, and what would your percentage return be on your investment? Ignore transactions costs.

XYZ Price Strike 52.65 55.00 55.00 60.00 60.00 52.65 52.65 52.65 56.90 55.00 56.90 55.00 56.90 60.00 56.90 60.00 Expiration Dec 2022 Mar 2023 Dec 2022 Mar 2023 Dec 2022 Mar 2023 Dec 2022 Mar 2023 - Call - Volume 9923 307 4578 212 1282 3645 468 2986 Price 2.28 3.68 0.94 2.10 3.09 5.09 0.86 2.81 - Put - Volume 2632 108 1875 76 1279 2856 156 1874 Price 4.35 5.48 7.99 8.85 1.10 2.82 3.86 5.51 Date of Quotation 9/15/2022 9/15/2022 9/15/2022 9/15/2022 11/15/2022 11/15/2022 11/15/2022 11/15/2022

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Answer The total dollar return of unwinding the option position on 11152022 is calculated as follows ... View full answer

Get step-by-step solutions from verified subject matter experts