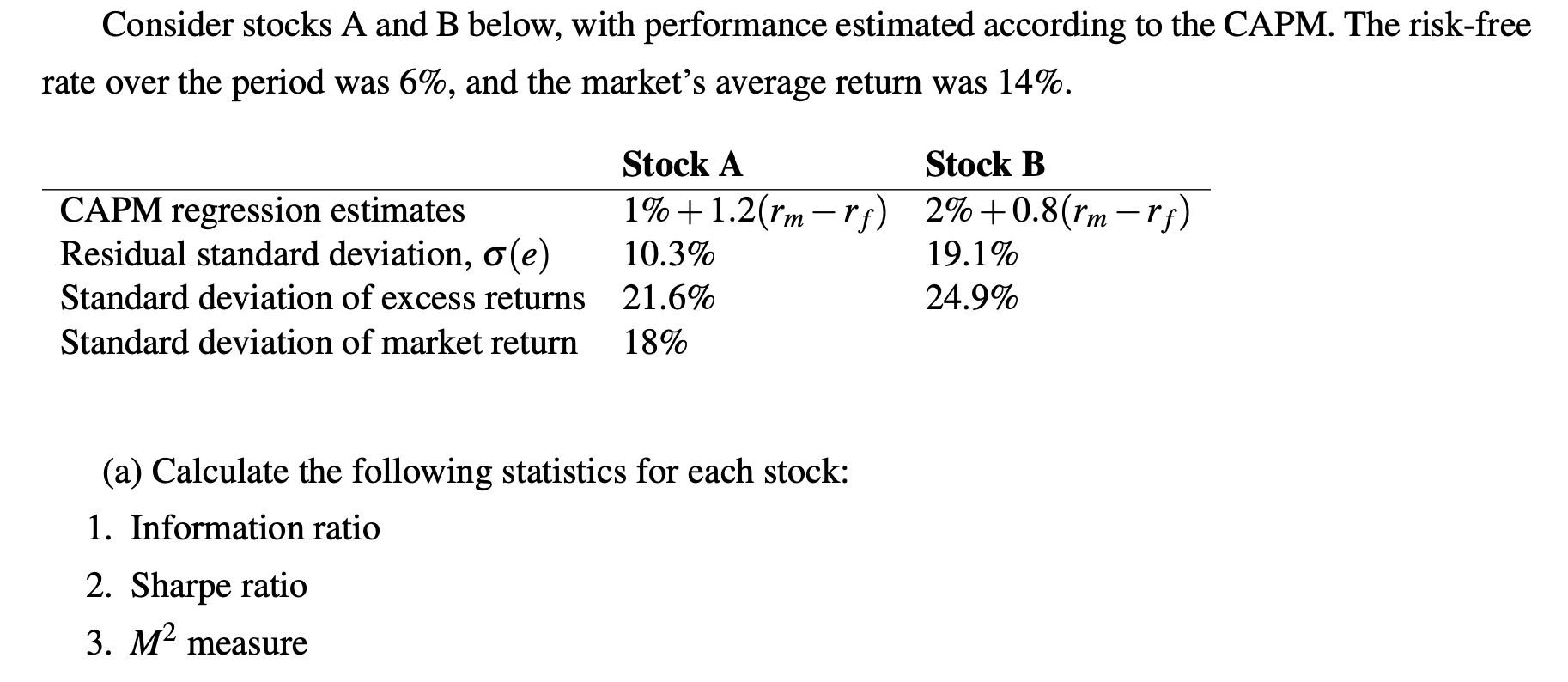

Question: Consider stocks A and B below, with performance estimated according to the CAPM. The risk-free rate over the period was 6%, and the market's

Consider stocks A and B below, with performance estimated according to the CAPM. The risk-free rate over the period was 6%, and the market's average return was 14%. 1%+1.2(rmr) 2%+0.8(rm -rf) Stock A CAPM regression estimates Residual standard deviation, (e) Standard deviation of excess returns Standard deviation of market return 10.3% 21.6% 18% (a) Calculate the following statistics for each stock: 1. Information ratio 2. Sharpe ratio 3. M measure Stock B 19.1% 24.9% 4. Treynor ratio (b) Which stock is best if it is the only risky asset held by the investor? (c) Which stock is best if it will be mixed with the rest of the investor's portfolio, which is currently composed of holding only the market portfolio?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts