Question: Consider Table 1 on the following page which summarizes five commercial real estate properties. Recall that if there is no balloon maturity, the maturity date

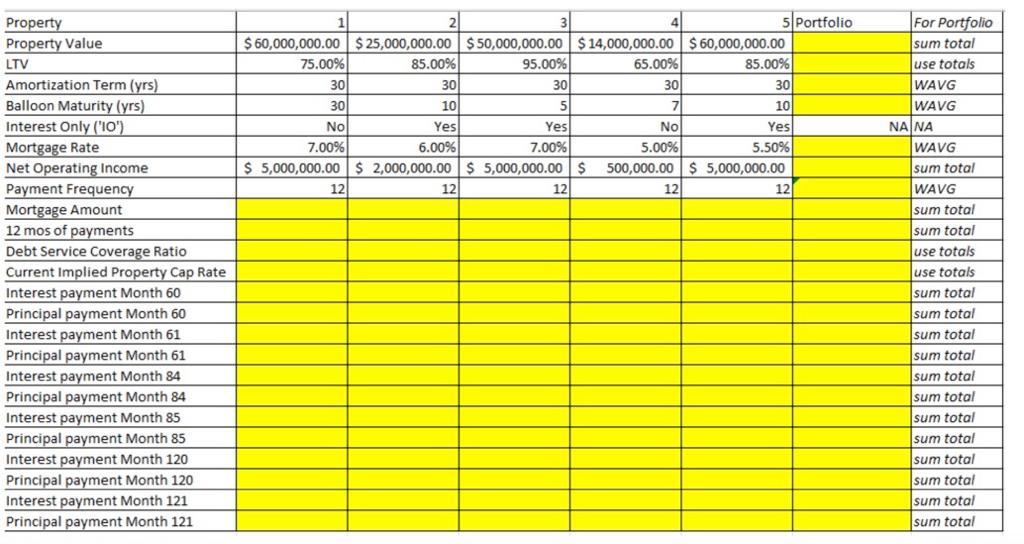

Consider Table 1 on the following page which summarizes five commercial real estate properties. Recall that if there is no balloon maturity, the maturity date of the loan is equal to the amortization term. Assume that all loans were originated by the lender(s) simultaneously on the same exact date. With this and your knowledge of Real Estate Finance in FIN 2949 create a worksheet with the inputs above and answer the following: a.) Provide all your calculations for the missing values for each of the properties 1 thru 5. You should use your mortgage calculator which you developed or were given in FIN 2949 to generate the principal and interest cashflows for each month for each mortgage. Copy those values into a worksheet, neatly labeled, and then use references or lookups functions to capture the missing interest and principal values required. In the case of the Portfolio aggregation calculations, I provide an adjacent column For Portfolio that tells you how to aggregate. sum total means sum up across the five properties for that rows item, So for example the Property Value Row is $209mm. `WAVG means weighted average. For these calculations, weight be mortgage amount, nor property value. For `use totals, use the total portfolio aggregate values for the calculation b.) In 200300 words in a text box explain which of the five loans is the mostrisky and which is the least risky from the perspective of the mortgage lender. c.) If all loans can be IOs and ratings agencies require for all loans to be in included in a securitization to have DSCR >1.05, which loans (if any) violate this restriction?

5 Portfolio $ 60,000,000.00 $ 25,000,000.00 $ 50,000,000.00 $ 14,000,000.00 $ 60,000,000.00 75.00% 85.00% 95.00% 65.00% 85.00% 30 30 30 30 30 30 10 5 7 10 NO Yes Yes No Yes 7.00% 6.00% 7.00% 5.00% 5.50% $ 5,000,000.00 $ 2,000,000.00 $ 5,000,000.00 $ 500,000.00 $ 5,000,000.00 12 12 12 12 12 Property Property Value LTV Amortization Term (yrs) Balloon Maturity (yrs) Interest Only ('10') Mortgage Rate Net Operating Income Payment Frequency Mortgage Amount 12 mos of payments Debt Service Coverage Ratio Current Implied Property Cap Rate Interest payment Month 60 Principal payment Month 60 Interest payment Month 61 Principal payment Month 61 Interest payment Month 84 Principal payment Month 84 Interest payment Month 85 Principal payment Month 85 Interest payment Month 120 Principal payment Month 120 Interest payment Month 121 Principal payment Month 121 For Portfolio sum total use totals WAVG WAVG NA NA WAVG sum total WAVG sum total sum total use totals use totals sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total 5 Portfolio $ 60,000,000.00 $ 25,000,000.00 $ 50,000,000.00 $ 14,000,000.00 $ 60,000,000.00 75.00% 85.00% 95.00% 65.00% 85.00% 30 30 30 30 30 30 10 5 7 10 NO Yes Yes No Yes 7.00% 6.00% 7.00% 5.00% 5.50% $ 5,000,000.00 $ 2,000,000.00 $ 5,000,000.00 $ 500,000.00 $ 5,000,000.00 12 12 12 12 12 Property Property Value LTV Amortization Term (yrs) Balloon Maturity (yrs) Interest Only ('10') Mortgage Rate Net Operating Income Payment Frequency Mortgage Amount 12 mos of payments Debt Service Coverage Ratio Current Implied Property Cap Rate Interest payment Month 60 Principal payment Month 60 Interest payment Month 61 Principal payment Month 61 Interest payment Month 84 Principal payment Month 84 Interest payment Month 85 Principal payment Month 85 Interest payment Month 120 Principal payment Month 120 Interest payment Month 121 Principal payment Month 121 For Portfolio sum total use totals WAVG WAVG NA NA WAVG sum total WAVG sum total sum total use totals use totals sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total sum total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts