Question: Consider that in class we categorized adjusting journal entries into categories and further, consider the following 3 situations from the Decipher Company fact pattern: C)

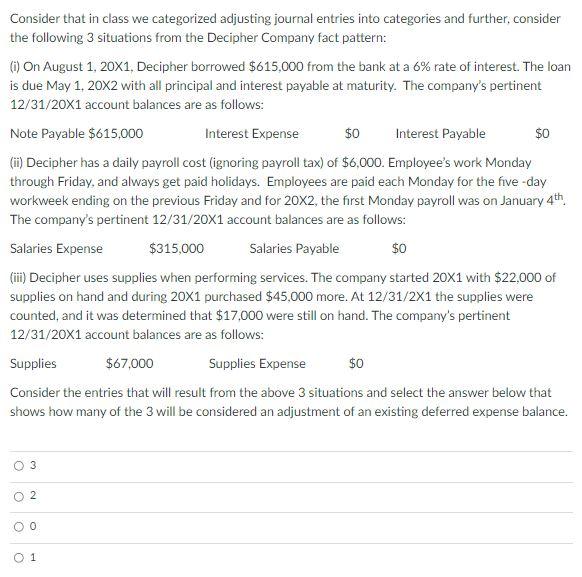

Consider that in class we categorized adjusting journal entries into categories and further, consider the following 3 situations from the Decipher Company fact pattern: C) On August 1, 20X1. Decipher borrowed $615.000 from the bank at a 6% rate of interest. The loan is due May 1, 20x2 with all principal and interest payable at maturity. The company's pertinent 12/31/20X1 account balances are as follows: Note Payable $615,000 Interest Expense $0 Interest Payable $0 (i) Decipher has a daily payroll cost (ignoring payroll tax) of $6,000. Employee's work Monday through Friday, and always get paid holidays. Employees are paid each Monday for the five-day workweek ending on the previous Friday and for 20x2, the first Monday payroll was on January 4th The company's pertinent 12/31/20X1 account balances are as follows: Salaries Expense $315,000 Salaries Payable $0 (i) Decipher uses supplies when performing services. The company started 20X1 with $22.000 of supplies on hand and during 20x1 purchased $45,000 more. At 12/31/2X1 the supplies were counted, and it was determined that $17,000 were still on hand. The company's pertinent 12/31/20X1 account balances are as follows: Supplies $67,000 Supplies Expense $0 Consider the entries that will result from the above 3 situations and select the answer below that shows how many of the 3 will be considered an adjustment of an existing deferred expense balance. 03 02 OO 0 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts