Question: Consider the 2-period binomial model with the same parameters as in problem A above. Investor e considers static investment strategies: Setting up a portfolio (x(O),

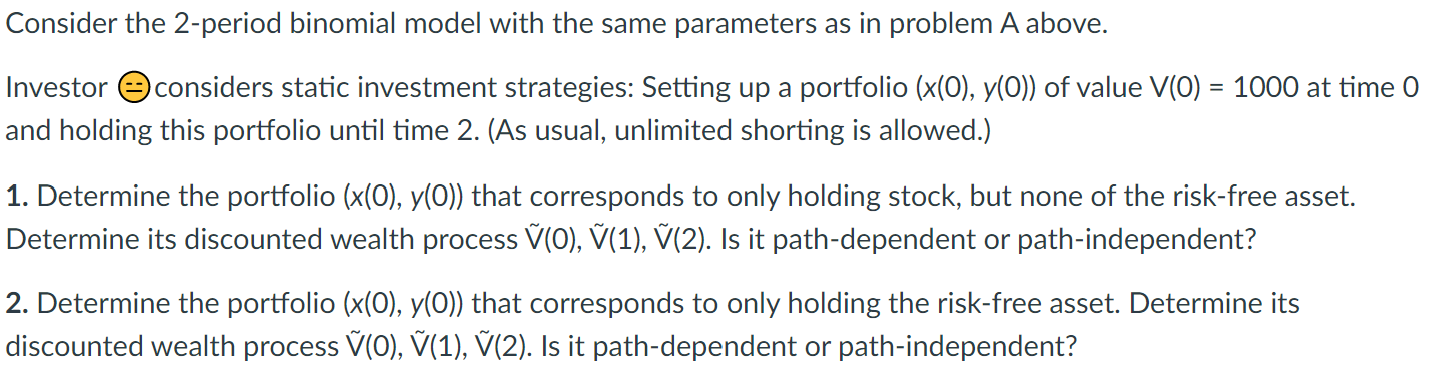

Consider the 2-period binomial model with the same parameters as in problem A above. Investor e considers static investment strategies: Setting up a portfolio (x(O), y(0)) of value V(O) = 1000 at time 0 and holding this portfolio until time 2. (As usual, unlimited shorting is allowed.) 1. Determine the portfolio (x(0), y(O)) that corresponds to only holding stock, but none of the risk-free asset. Determine its discounted wealth process V(O), (1), V(2). Is it path-dependent or path-independent? 2. Determine the portfolio (x(O), y(O)) that corresponds to only holding the risk-free asset. Determine its discounted wealth process (O), (1), V(2). Is it path-dependent or path-independent? Consider the 2-period binomial model with the same parameters as in problem A above. Investor e considers static investment strategies: Setting up a portfolio (x(O), y(0)) of value V(O) = 1000 at time 0 and holding this portfolio until time 2. (As usual, unlimited shorting is allowed.) 1. Determine the portfolio (x(0), y(O)) that corresponds to only holding stock, but none of the risk-free asset. Determine its discounted wealth process V(O), (1), V(2). Is it path-dependent or path-independent? 2. Determine the portfolio (x(O), y(O)) that corresponds to only holding the risk-free asset. Determine its discounted wealth process (O), (1), V(2). Is it path-dependent or path-independent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts