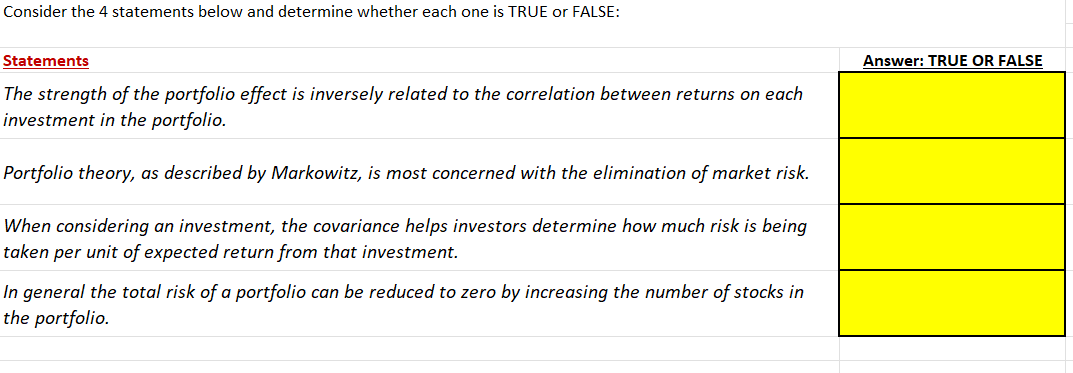

Question: Consider the 4 statements below and determine whether each one is TRUE or FALSE: Statements Answer: TRUE OR FALSE The strength of the portfolio effect

Consider the 4 statements below and determine whether each one is TRUE or FALSE: Statements Answer: TRUE OR FALSE The strength of the portfolio effect is inversely related to the correlation between returns on each investment in the portfolio. Portfolio theory, as described by Markowitz, is most concerned with the elimination of market risk. When considering an investment, the covariance helps investors determine how much risk is being taken per unit of expected return from that investment. In general the total risk of a portfolio can be reduced to zero by increasing the number of stocks in the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts