Question: Consider the above information and determine the final physical inventory value that Rally should use to compare to the general ledger. Rally Company is a

Consider the above information and determine the final physical inventory value that Rally should use to compare to the general ledger.

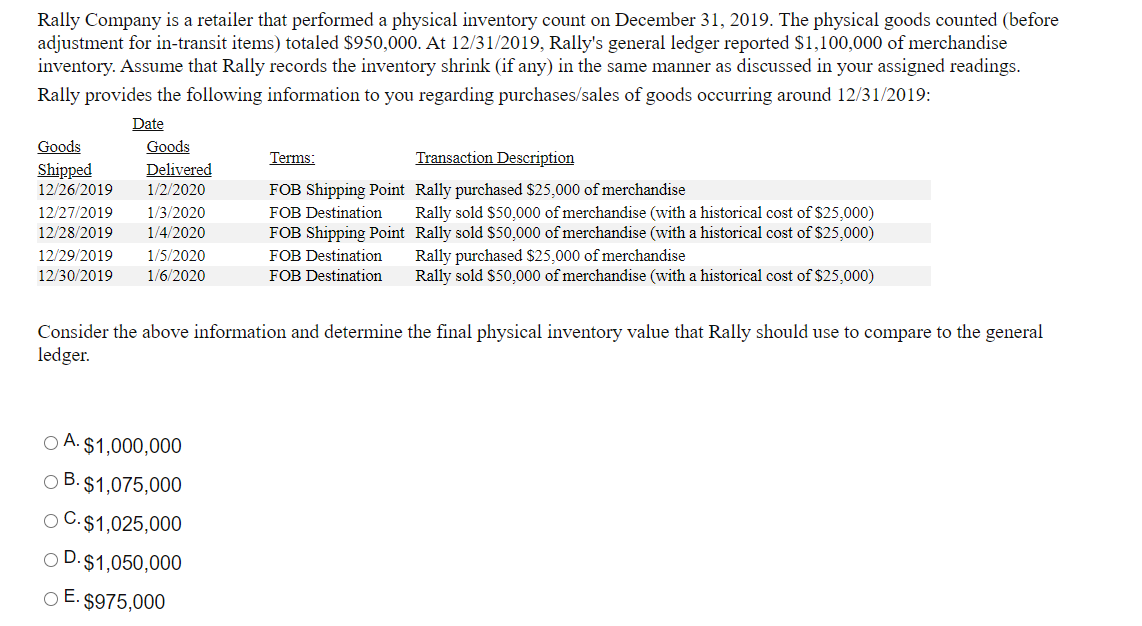

Rally Company is a retailer that performed a physical inventory count on December 31, 2019. The physical goods counted (before adjustment for in-transit items) totaled $950,000. At 12/31/2019, Rally's general ledger reported $1,100,000 of merchandise inventory. Assume that Rally records the inventory shrink (if any) in the same manner as discussed in your assigned readings. Rally provides the following information to you regarding purchases/sales of goods occurring around 12/31/2019: Date Goods Goods Shipped Delivered Terms: Transaction Description 12/26/2019 1/2/2020 FOB Shipping Point Rally purchased $25,000 of merchandise 12/27/2019 1/3/2020 FOB Destination Rally sold $50,000 of merchandise (with a historical cost of $25,000) 12/28/2019 1/4/2020 FOB Shipping Point Rally sold $50,000 of merchandise (with a historical cost of $25,000) 12/29/2019 1/5/2020 FOB Destination Rally purchased $25,000 of merchandise 12/30/2019 1/6/2020 FOB Destination Rally sold $50,000 of merchandise (with a historical cost of $25,000) Consider the above information and determine the final physical inventory value that Rally should use to compare to the general ledger. O A. $1,000,000 O B. $1,075,000 O C. $1,025,000 O D. $1,050,000 O E. $975,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts