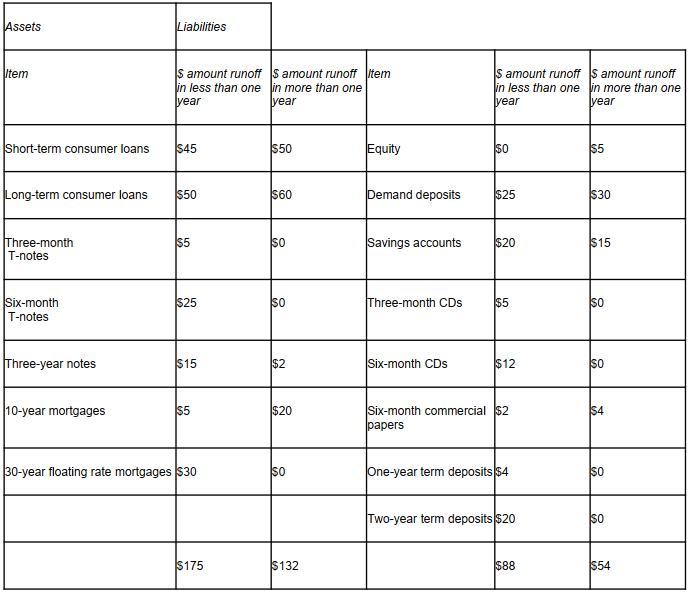

Question: Consider the above table: 1/ What is the one-year gap adjusted for runoffs? A. $43 B. $87 C. $121 D. $78 2/ How does a

Consider the above table:

1/ What is the one-year gap adjusted for runoffs? A. $43 B. $87 C. $121 D. $78

2/ How does a decrease in the average one-year interest rate of 50 basis points affect the FI's future net interest income? A. The NII decreases by $0.435. B. The NII increases by $0.435. C. The NII remains constant. D. The NII decreases by $0.39.

Assets Liabilities Vtem s amount runoff s amount runoff Item in less than one in more than one Iyear year $ amount runoff S amount runoff in less than one \in more than one year [year Short-term consumer loans $45 $50 Equity $0 $5 Long-term consumer loans $50 $60 Demand deposits $25 $30 $5 SO Savings accounts $20 Three-month T-notes $15 $25 so Three-month CDs $5 Six-month T-notes So Three-year notes $15 $2 Six-month CDs $12 SO 10-year mortgages $5 $20 $4 Six-month commercial $2 papers 30-year floating rate mortgages $30 SO One-year term deposits $4 SO Two-year term deposits $20 SO $175 $132 $88 $54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts