Question: Consider the accompanying Markov chain transition matrix for collateral underlying a structured transaction. This collateral has a WAC of 12% and a WAM of

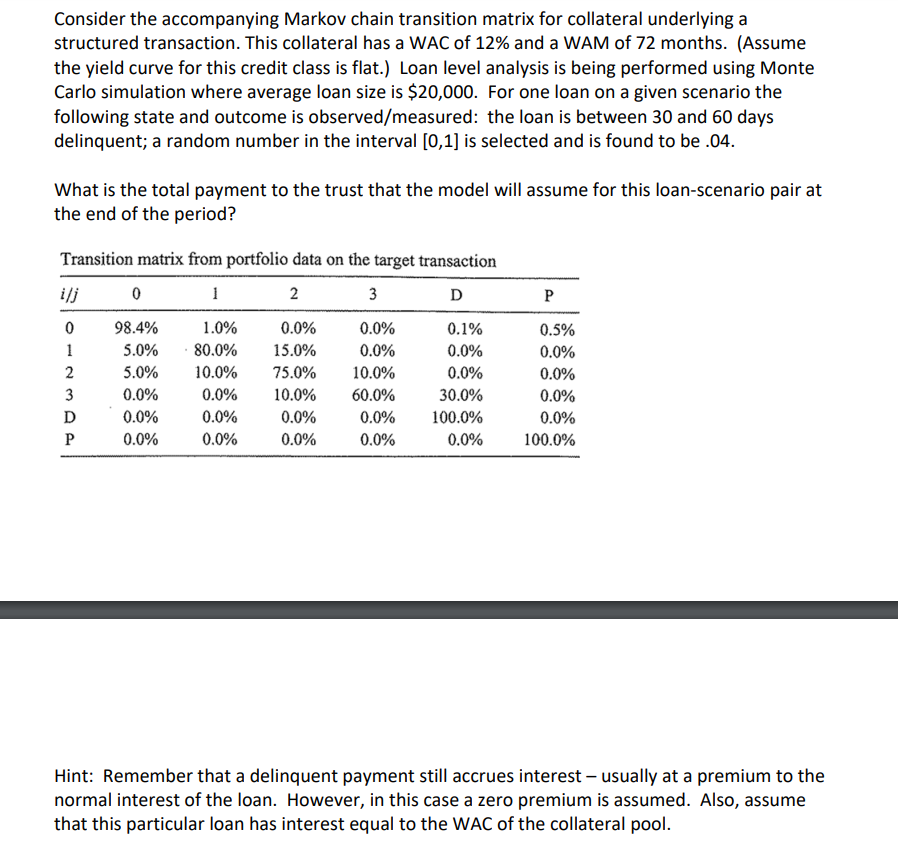

Consider the accompanying Markov chain transition matrix for collateral underlying a structured transaction. This collateral has a WAC of 12% and a WAM of 72 months. (Assume the yield curve for this credit class is flat.) Loan level analysis is being performed using Monte Carlo simulation where average loan size is $20,000. For one loan on a given scenario the following state and outcome is observed/measured: the loan is between 30 and 60 days delinquent; a random number in the interval [0,1] is selected and is found to be .04. What is the total payment to the trust that the model will assume for this loan-scenario pair at the end of the period? Transition matrix from portfolio data on the target transaction i/j 0 1 2 3 P 0 98.4% 1.0% 0.0% 0.0% 0.1% 0.5% 1 5.0% 80.0% 15.0% 0.0% 0.0% 0.0% 2 5.0% 10.0% 75.0% 10.0% 0.0% 0.0% 3 0.0% 0.0% 10.0% 60.0% 30.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 100.0% Hint: Remember that a delinquent payment still accrues interest - usually at a premium to the normal interest of the loan. However, in this case a zero premium is assumed. Also, assume that this particular loan has interest equal to the WAC of the collateral pool.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts