Question: Consider the accounting data below for the Gibson Co. for 2021. The firm pays corporate taxes at the flat 21% Corporate Rate. What is the

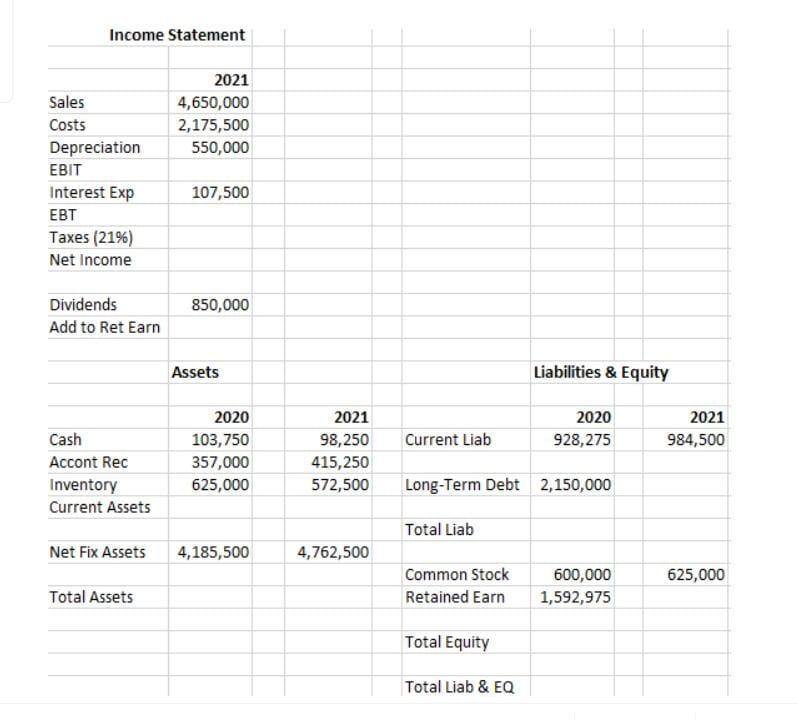

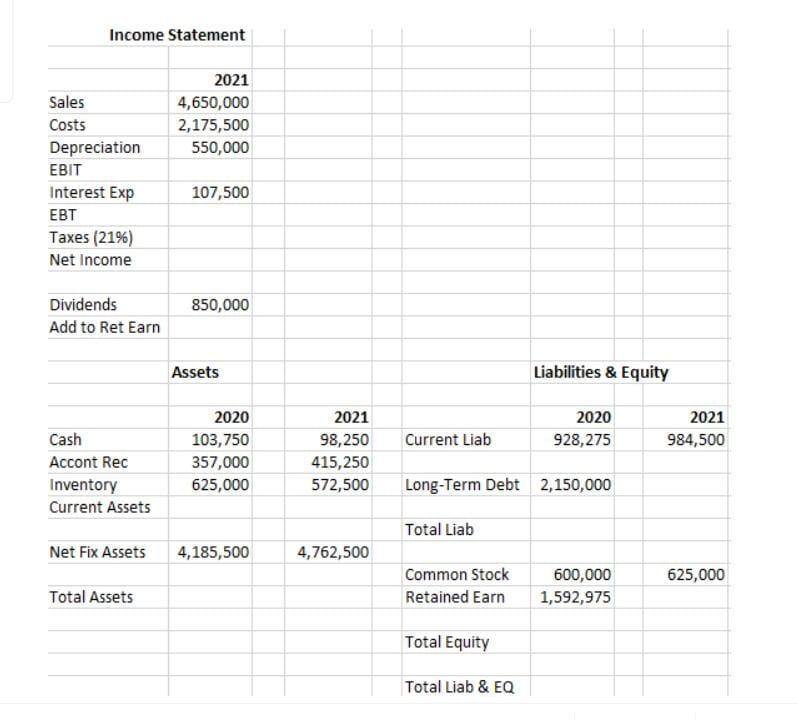

Consider the accounting data below for the Gibson Co. for 2021. The firm pays corporate taxes at the flat 21% Corporate Rate.

What is the Addition to Retained Earnings for 2021? [Present the answer rounded to the nearest dollar, e.g. 359462]

Income Statement Sales Costs Depreciation EBIT Interest Exp EBT Taxes (21%) Net Income Dividends Add to Ret Earn Cash Accont Rec Inventory Current Assets Net Fix Assets Total Assets 2021 4,650,000 2,175,500 550,000 107,500 850,000 Assets 2020 103,750 357,000 625,000 4,185,500 2021 98,250 415,250 572,500 4,762,500 Current Liab Total Liab Long-Term Debt 2,150,000 Common Stock Retained Earn Total Equity Liabilities & Equity Total Liab & EQ 2020 928,275 600,000 1,592,975 2021 984,500 625,000

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step 13 Solution First calculate EBIT as follow EBITSalesCostdepreciation 4650000217550055000 192450... View full answer

Get step-by-step solutions from verified subject matter experts