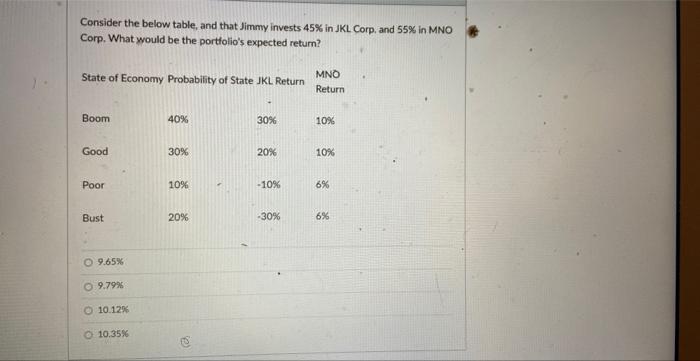

Question: Consider the below table, and that Jimmy invests 45% in JKL Corp, and 55% in MNO Corp. What would be the portfolio's expected retum? 9.65%

Consider the below table, and that Jimmy invests 45% in JKL Corp, and 55% in MNO Corp. What would be the portfolio's expected retum? 9.65% 9.798 10.1275 10.35% Same facts as above: what would be the portfolio's variance? 0.92% 1.33% 1.56% 2.12% Same facts as above: what would be the portfolio's standard deviation? 1.33% 0.92% 12.54% 11.51%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock