Question: Consider the binomial model that we saw in class. The underlying stock S can have values of Su =$140 and Sd=$80 at time t=1 (one

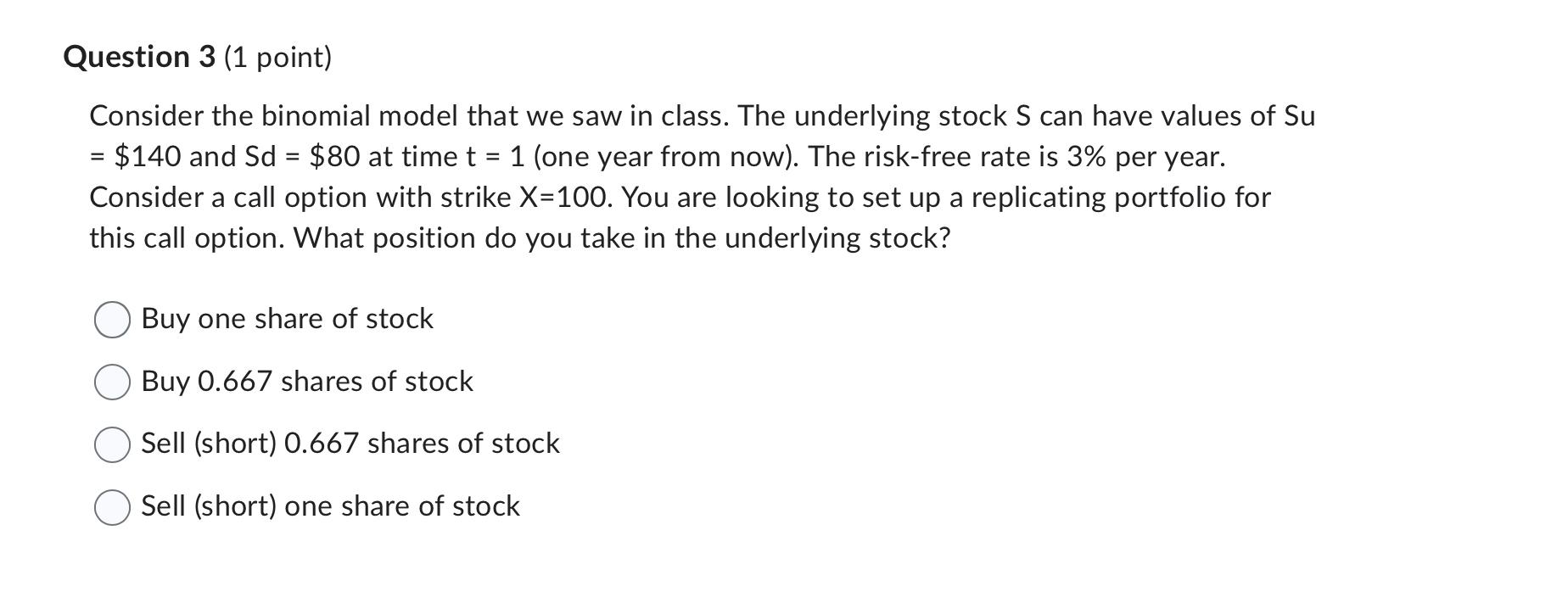

Consider the binomial model that we saw in class. The underlying stock S can have values of Su =$140 and Sd=$80 at time t=1 (one year from now). The risk-free rate is 3% per year. Consider a call option with strike X=100. You are looking to set up a replicating portfolio for this call option. What position do you take in the underlying stock? Buy one share of stock Buy 0.667 shares of stock Sell (short) 0.667 shares of stock Sell (short) one share of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts