Question: Consider the cash flow data in the table below for two competing investment projects. At i= 11%, which of the two projects would be

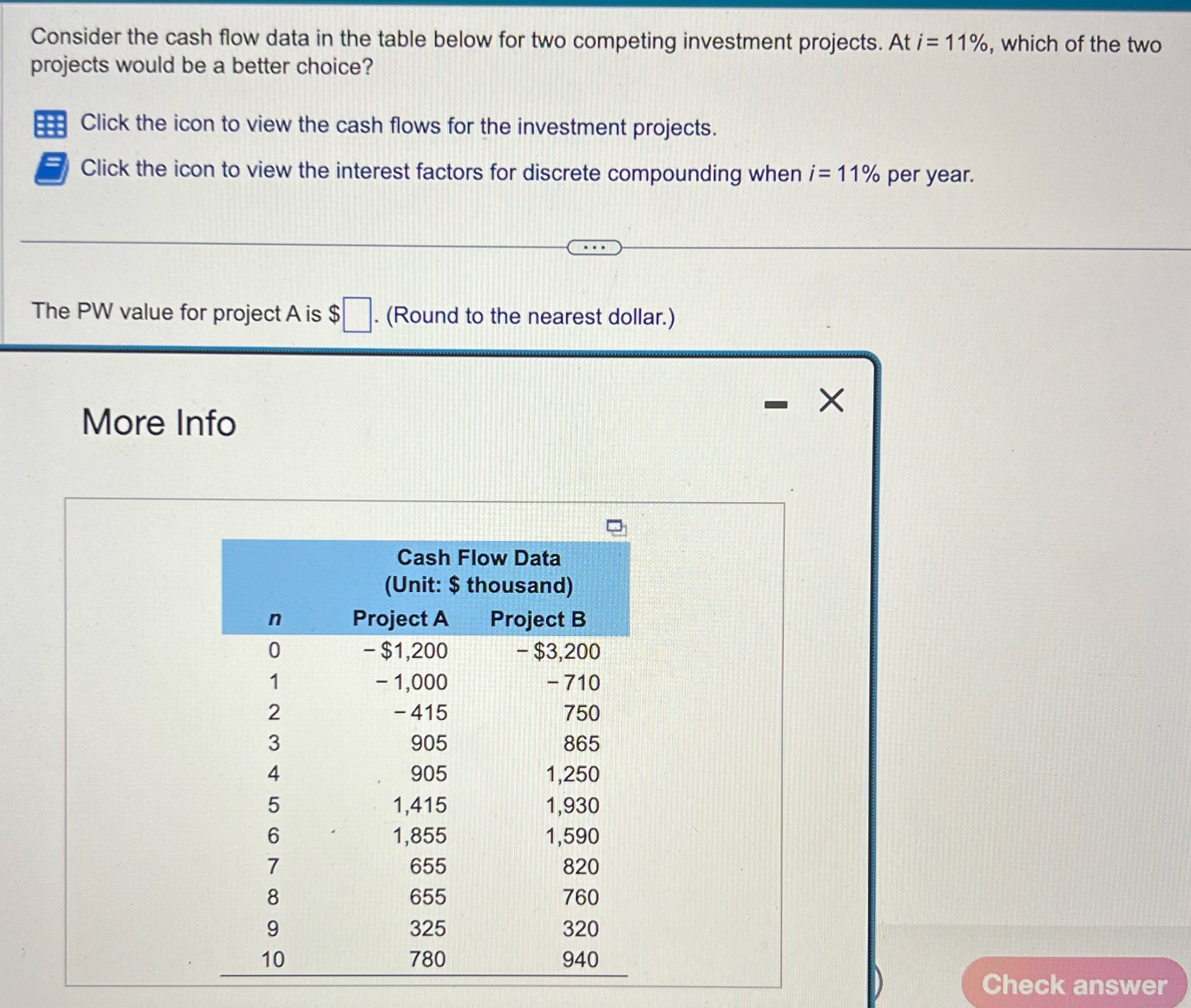

Consider the cash flow data in the table below for two competing investment projects. At i= 11%, which of the two projects would be a better choice? Click the icon to view the cash flows for the investment projects. Click the icon to view the interest factors for discrete compounding when i= 11% per year. The PW value for project A is $ More Info HEELS SAWN LOG 2 3 6 10 (Round to the nearest dollar.) Cash Flow Data (Unit: $ thousand) Project A - $1,200 - 1,000 - 415 905 905 1,415 1,855 655 655 325 780 ... Project B - $3,200 - 710 750 865 1,250 1,930 1,590 820 760 320 940 - X Check answer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts