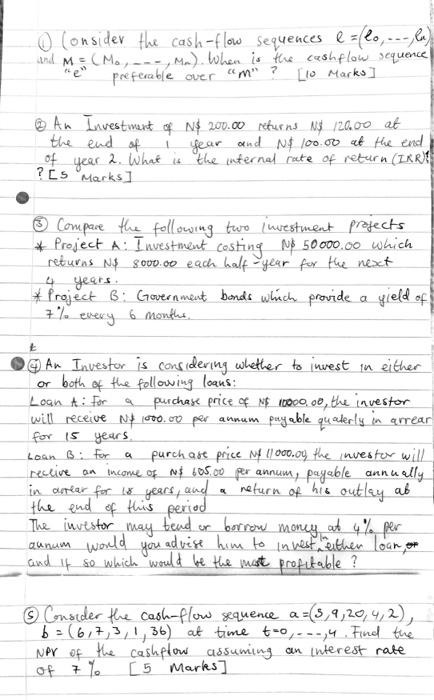

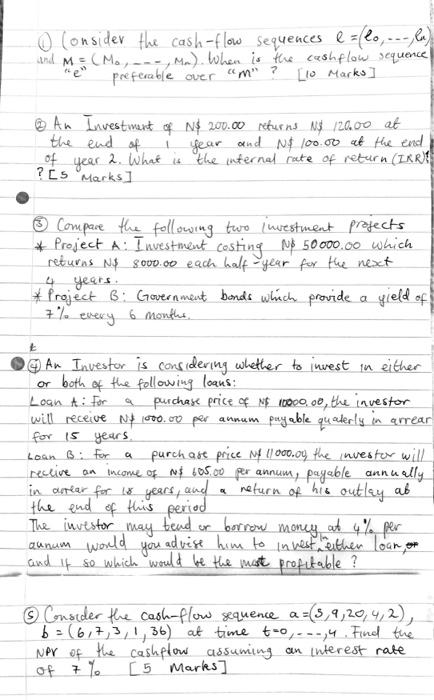

Question: Consider the cash-flow sequences @ = (lo, ---,C) and M = (MoMA). When is the cashflow sequence preferable over mp3 10 Marks An Investment of

Consider the cash-flow sequences @ = (lo, ---,C) and M = (MoMA). When is the cashflow sequence preferable over mp3 10 Marks An Investment of N$ 200.00 returns N$ 120,00 at the end of year and No 100.00 at the end of ?CS Marks] 2. What is the internal rate of return (IRRT year Compare the following two investment projects Project A: Investment costing MP 50000.00 which retuvas N$ Soud.co each half-year for the next years. & Project B: Government bonds which provide a gield of 6 months 4 t or both Loan B. for a An Investor is considering whether to invest in either of the following loans: Loan A: For purchase price N10000,00, the investor will receive Nx 100. or per annum puyable quaderly, in arrear for is years. purchase price MF 11 000.0y the nuester will receive an income of $ 605.00 per annum, payable annually in arrear for it years, and return of his outlay at the end of this period The investor may borrow money aunum would you advise him to invest either loan of and if so which would be the most profitable ? ut 4% per Consider the cash-flow sequence a =(5,9, 20, 4,2), b = (6, 7, 3, 1, 36) at time too...,4. Find the Nor of the cashflow assuming an interest rate [5 Marles] of 7% Consider the cash-flow sequences @ = (lo, ---,C) and M = (MoMA). When is the cashflow sequence preferable over mp3 10 Marks An Investment of N$ 200.00 returns N$ 120,00 at the end of year and No 100.00 at the end of ?CS Marks] 2. What is the internal rate of return (IRRT year Compare the following two investment projects Project A: Investment costing MP 50000.00 which retuvas N$ Soud.co each half-year for the next years. & Project B: Government bonds which provide a gield of 6 months 4 t or both Loan B. for a An Investor is considering whether to invest in either of the following loans: Loan A: For purchase price N10000,00, the investor will receive Nx 100. or per annum puyable quaderly, in arrear for is years. purchase price MF 11 000.0y the nuester will receive an income of $ 605.00 per annum, payable annually in arrear for it years, and return of his outlay at the end of this period The investor may borrow money aunum would you advise him to invest either loan of and if so which would be the most profitable ? ut 4% per Consider the cash-flow sequence a =(5,9, 20, 4,2), b = (6, 7, 3, 1, 36) at time too...,4. Find the Nor of the cashflow assuming an interest rate [5 Marles] of 7% Consider the cash-flow sequences @ = (lo, ---,C) and M = (MoMA). When is the cashflow sequence preferable over mp3 10 Marks An Investment of N$ 200.00 returns N$ 120,00 at the end of year and No 100.00 at the end of ?CS Marks] 2. What is the internal rate of return (IRRT year Compare the following two investment projects Project A: Investment costing MP 50000.00 which retuvas N$ Soud.co each half-year for the next years. & Project B: Government bonds which provide a gield of 6 months 4 t or both Loan B. for a An Investor is considering whether to invest in either of the following loans: Loan A: For purchase price N10000,00, the investor will receive Nx 100. or per annum puyable quaderly, in arrear for is years. purchase price MF 11 000.0y the nuester will receive an income of $ 605.00 per annum, payable annually in arrear for it years, and return of his outlay at the end of this period The investor may borrow money aunum would you advise him to invest either loan of and if so which would be the most profitable ? ut 4% per Consider the cash-flow sequence a =(5,9, 20, 4,2), b = (6, 7, 3, 1, 36) at time too...,4. Find the Nor of the cashflow assuming an interest rate [5 Marles] of 7% Consider the cash-flow sequences @ = (lo, ---,C) and M = (MoMA). When is the cashflow sequence preferable over mp3 10 Marks An Investment of N$ 200.00 returns N$ 120,00 at the end of year and No 100.00 at the end of ?CS Marks] 2. What is the internal rate of return (IRRT year Compare the following two investment projects Project A: Investment costing MP 50000.00 which retuvas N$ Soud.co each half-year for the next years. & Project B: Government bonds which provide a gield of 6 months 4 t or both Loan B. for a An Investor is considering whether to invest in either of the following loans: Loan A: For purchase price N10000,00, the investor will receive Nx 100. or per annum puyable quaderly, in arrear for is years. purchase price MF 11 000.0y the nuester will receive an income of $ 605.00 per annum, payable annually in arrear for it years, and return of his outlay at the end of this period The investor may borrow money aunum would you advise him to invest either loan of and if so which would be the most profitable ? ut 4% per Consider the cash-flow sequence a =(5,9, 20, 4,2), b = (6, 7, 3, 1, 36) at time too...,4. Find the Nor of the cashflow assuming an interest rate [5 Marles] of 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts